The Unknowing Trader: Make it Boring (The Seven Day Scope-Snipers Only)

Free weekly report available on Fridays (Subscribe and never miss a report)

“All of humanity's problems stem from man's inability to sit quietly in a room alone.”

―Blaise Pascal,Pensées

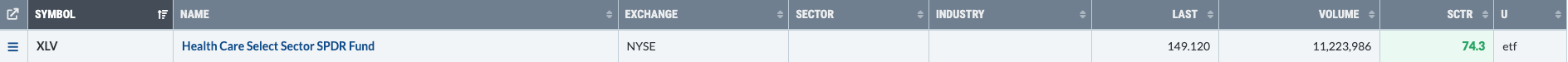

ETFs making new 52 week highs.

Major sectors making new 52 week highs.

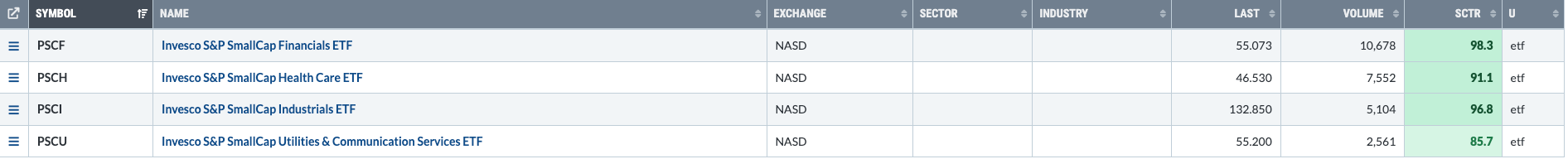

Small cap sectors making new 52 week highs.

The only sector that is making 52 week highs compared to the SPX.

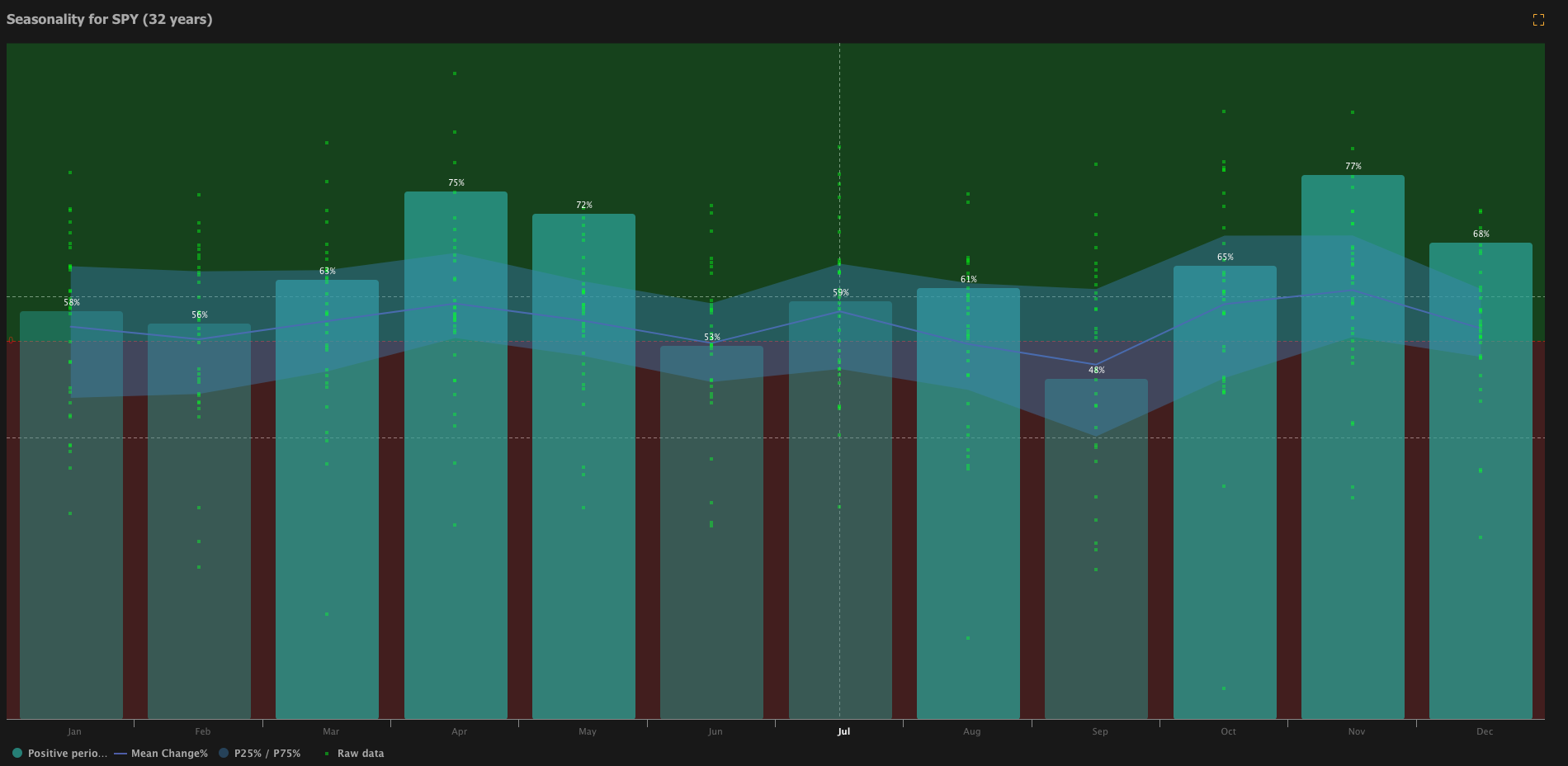

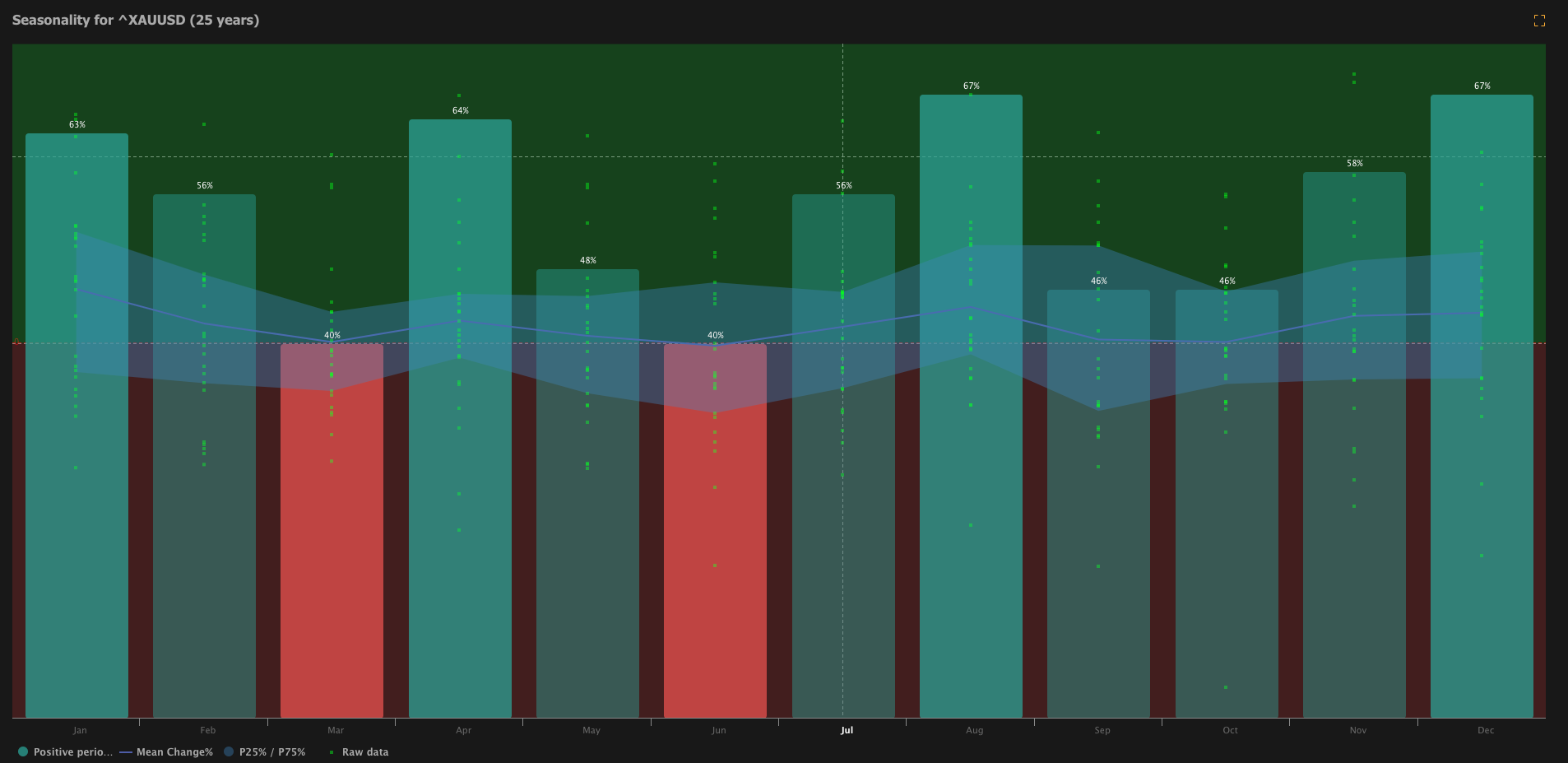

Seasonality/major asset classes

Gold

When people are bored, it is primarily with their own selves that they are bored. – Eric Hoffer

Crude oil

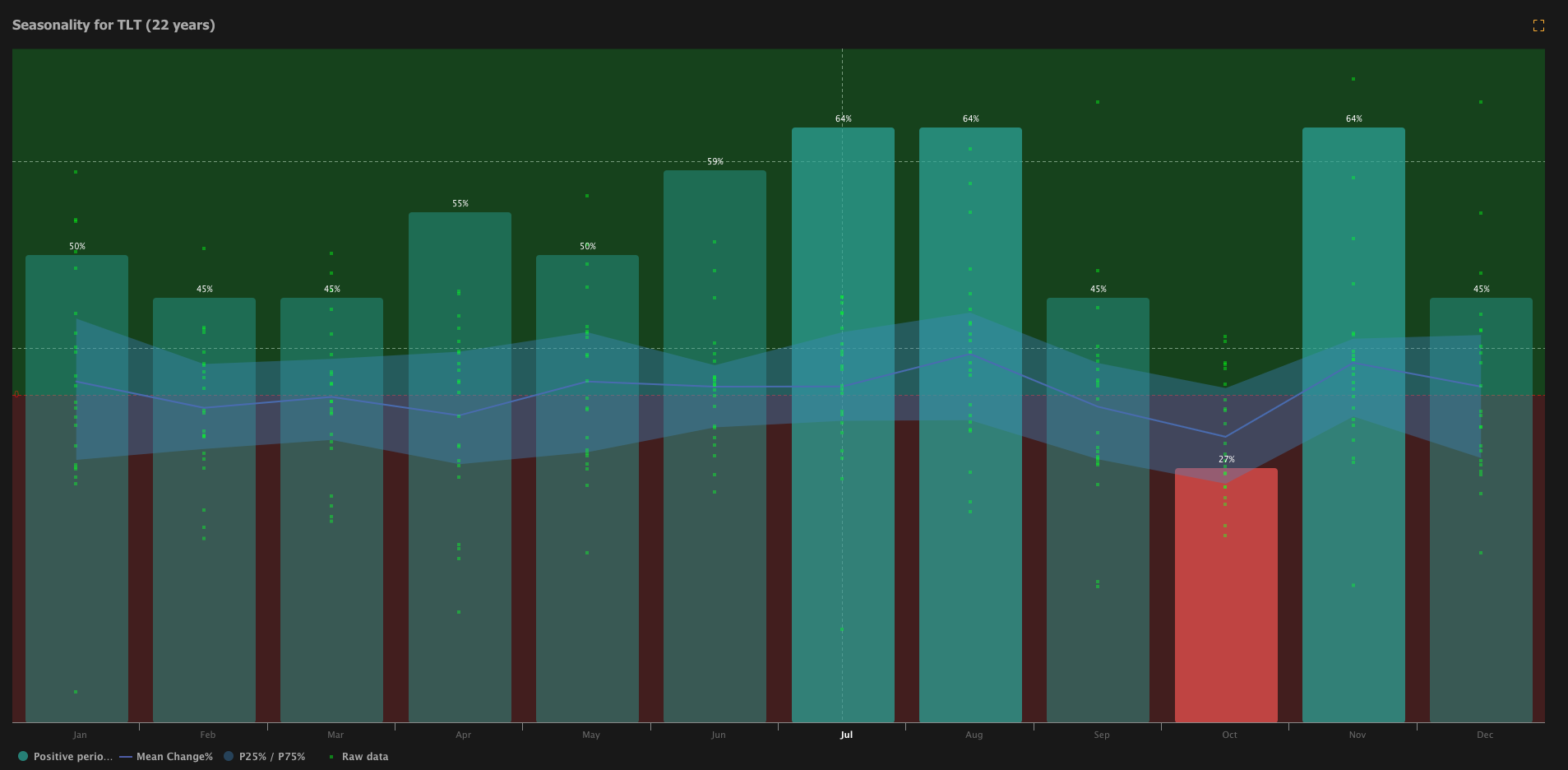

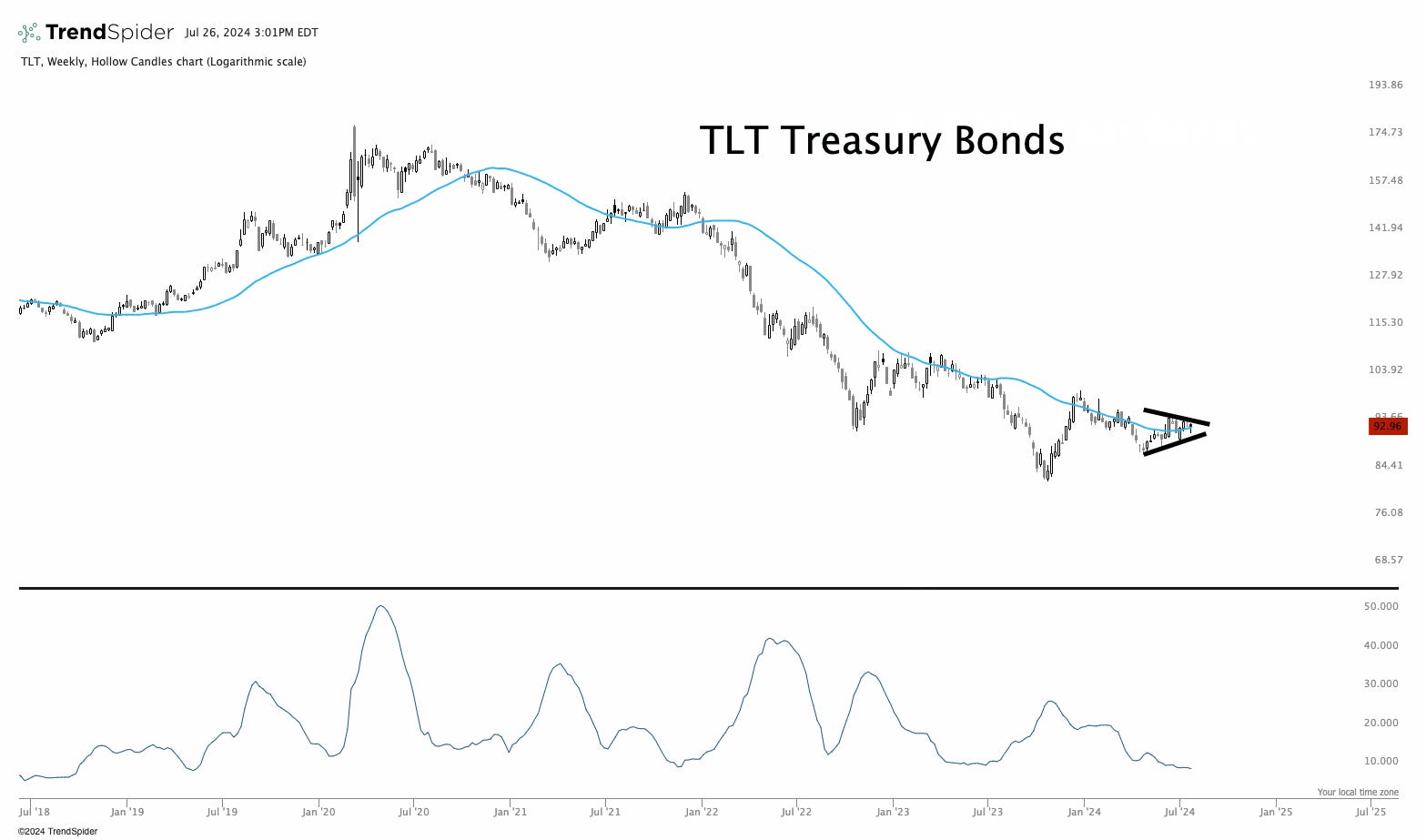

TLT/Bonds

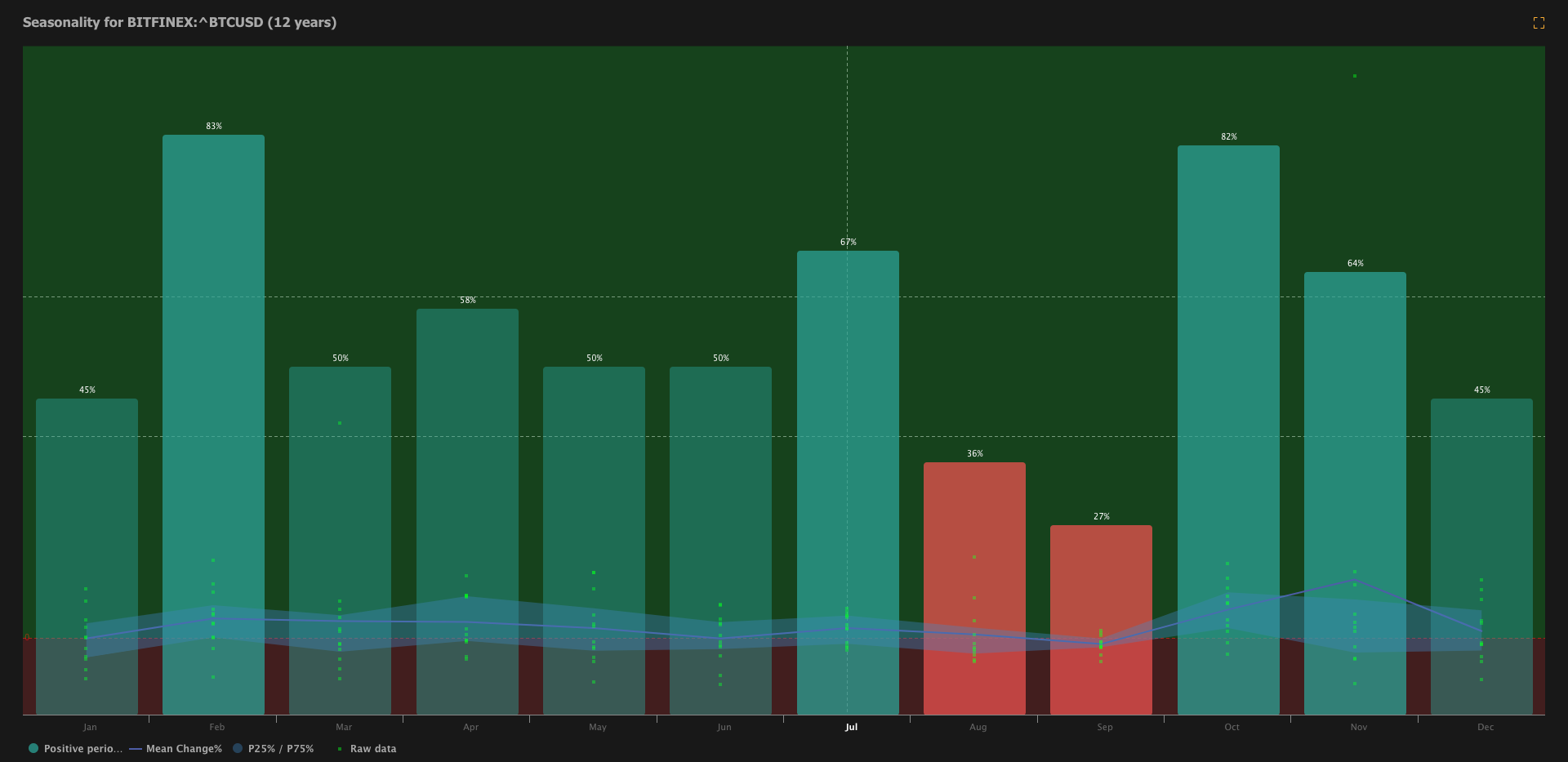

Bitcoin

Going forward, most of this will be behind the pay wall and we will go a bit deeper. I want to make this page more about process over ideas.

Ok so here is a trade idea. Yes I know I don’t have new trade ideas every issue because I believe everyone needs to trade a hell of a lot less than they do. Let’s be honest, I really could give a shit less about creating a product that everyone clicks on. I do care about teaching others how to do this and how this works as opposed to how it does not work. Showing people a list of my “greatest hits” would bring in more people. Showing you how my monthly and quarterly returns look, that teaches everyone how this really works.

Futures trades. Look for this band squeeze breakout!

Set your buy stop above this level. Also I will alert our group in our trading chat when it comes through.

ETF traders

If you are buying the ETF, look for a close above 95 to enter this position.

Options traders

Buy the September 20 monthlies at the 98 strike. The premium will be cheaper if you buy them today but the probability of the trade working goes up if you wait until it clears 95.

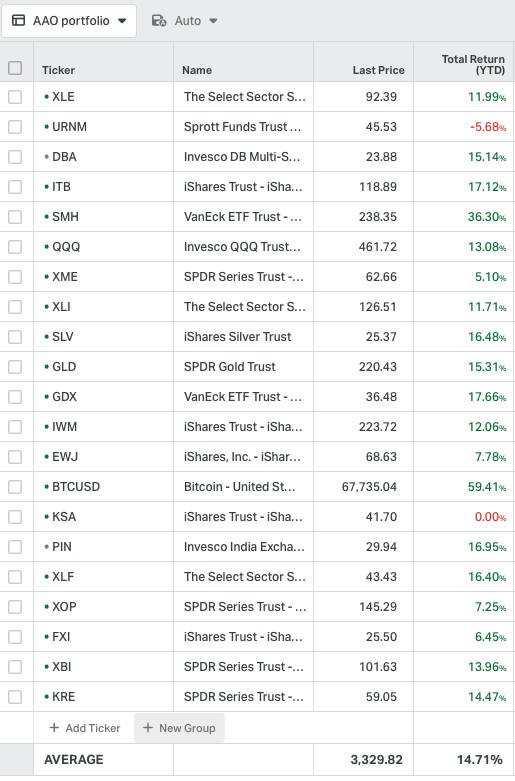

In our boring portfolio (for free subscribers who don’t know, we have 2 portfolios, one that uses leverage/options/futures which shoots for higher returns, more volatility and one that does not aka the boring portfolio that we post) only one sub sector is not long at the moment in the energy ETF majors.

Paid subscribers get access to both portfolios. Futures portfolio is sitting at 35% this year. It was over 70% in 2023 and we had a 2 triple digit years in 2020 and 2021. Dig through our posts to see it.

Buy on a close above 346 and yes we will update you when we get the signal…

Our scanners are also showing that a few things are showing major relative strength, financials, industrials, bonds and a few energy sectors.

The Swiss Frank is a buy right here right now!

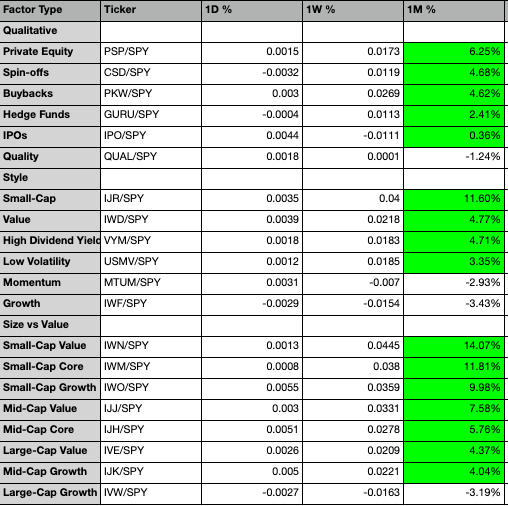

I want you all to see what has happened over the last month. MAJOR and I mean MAJOR relative strength is flowing out of large cap growth and in tho small cap value. Pay attention, this is where things get interesting.

Monday we will be adding an inter market analysis section and more to our Monday report for paid subscribers. I will see you then.

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees:

Help save the native bees! Learn more and get involved here.

Triple digit returns in 2020 and 2021 is extremely impressive. So is 35% this year. Any thoughts on why the bull markets in 2020 and 2021 were much better years compared to the 2024 bull market so far for you?