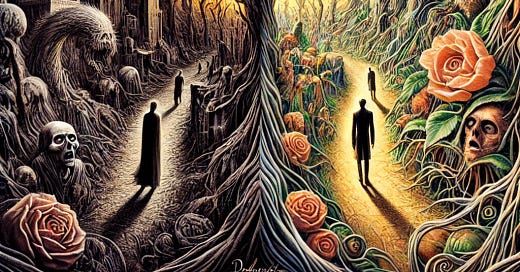

There is No Present, Only History, Only Futures: The Dead Zone

"Death is certain," the mural said, "but life is not."

🗣️🧠 Stay connected-I don’t have much more to say than that. I am a terrible marketer, but I am a damn good trader.

“Rotation is the lifeblood of any bull market” Ralph Acompora

In this week's newsletter, we jump into the strategic parallels between gardening for pollinators and navigating the current market environment:

1. Understanding Market and Nature's Cycles: Just as gardeners plan for continuous bloom to support pollinators through the seasons, traders must understand and adapt to the cyclical nature of markets. The mid-summer 'dead zone' in gardens, paralleled by low liquidity and volume in markets, challenges both bees and traders to sustain their activities effectively.

2. Tactical Asset Rotation – Key to Long-Term Growth: Highlighting Meb Faber's rotation strategy, we explore how diversification across asset classes based on momentum and valuation can shield investments from volatility and enhance returns. This approach mirrors a gardener's strategy of rotating blooms to provide constant support to pollinators.

3. Global Economic Trends and Market Signals: We also cover the broader economic canvas, noting significant rate cuts globally and their implications on market dynamics. With our pulse on commodities, we observe current trends from the USDA report and discuss their potential impacts on future market conditions, emphasizing the importance of staying informed and ready to adapt.

I had this thought yesterday…. feel free to skip if you’d like but it pertains to trading. Rotating flowers to support pollinators in Ohio involves planning a garden that blooms continuously throughout the growing season, ensuring that there is always a food source available for various pollinator species. This technique not only aids in the survival of bees, which are crucial pollinators, but it also enhances the health and beauty of your garden.

Start by selecting a variety of native plants that bloom at different times of the year. Spring bloomers such as wild lupine and foxglove beardtongue provide early nectar and pollen, crucial for bees emerging from hibernation. Summer flowers, including purple coneflower and black-eyed Susan, sustain bees during the busiest part of their foraging season. For late season, consider planting asters and goldenrod, which offer vital resources as bees prepare for winter. The key is to ensure overlapping bloom times so that as one plant's flowers begin to fade, another starts to blossom.

In addition to selecting a variety of plants, consider the planting arrangement and maintenance of your garden to support bee health. Clustering same-species plants in groups can create a "target-rich" environment, making it easier for bees to forage efficiently. Avoiding pesticides, or opting for organic options, will help protect the bees from harmful chemicals. Regularly adding new plants to the rotation each year can also rejuvenate your garden's appeal to bees, providing them with a diverse and consistent source of food.

Not the most beautiful garden at the moment. This is the dead zone in the summer. As we are in a low volume zone for traders.

During this time, pollinators may struggle to find enough nectar and pollen to sustain their energy needs. This can be particularly challenging for pollinators, which require continuous access to pollen and nectar to feed their colonies and produce honey. The lack of food can stress bee populations, reduce their ability to store food for winter, and lower their overall health and reproductive success.

How does this apply to trading?

I have been talking about the summer doldrums since May. Low liquidity, election year and low volume. This is a recipe for volatility. There is a pattern to markets and nature. Understanding these patterns will help you to plan, diversify and therefor increase your returns.

Just like the bees, we have to choose our spots carefully here. We are in the dead zone.

On Monday we had Patrick De Haan on from the GasBuddy app.

This is a deep dive in to the energy, oil, gasoline and diesel complex. Now let’s dig in to the rest of the commodities complex.