Trend Following Part 3: The Math That Keeps You in the Game

Big Wins Matter. But Surviving the Losses Matters More.

Most people think the secret to trading is knowing what to buy.

It’s not.

The real secret is knowing how much to buy — and how much to risk when you’re wrong.

Because being wrong is guaranteed. And if you size too big when that happens, it doesn’t matter how many times you’re right later.

Volatility is the market’s way of telling you how loud it's breathing. When it breathes heavy, you take smaller steps. When it calms down, you walk more confidently. Not recklessly. Just measured.

This position sizing model doesn’t make you rich overnight.

It keeps you in the game long enough to let good decisions compound.

That’s where the real edge lives.

📐 Systematic Position Sizing Guide for All ETF Types

Built around volatility, risk management, and consistency

⚖️ Step 1: Define Your Portfolio Risk Per Trade

Choose a fixed % of your total portfolio you’re willing to risk per trade.

Typical range:

Conservative: 0.5%

Balanced: 1%

Aggressive: 1.5%–2%

Example: $100K account at 1% risk = $1,000 max risk per trade

📊 Step 2: Measure Volatility for the ETF

Use Average True Range (ATR) to calculate recent price volatility.

Recommended: 14-day ATR

Also, note the dollar volatility of each ETF.

Example (XLE):

ATR = 1.80

Stop Loss = 2× ATR = 3.60

Entry Price = $94

Stop Loss Price = $90.40

Risk per share = $3.60

🔢 Step 3: Calculate Position Size

Position Size = Account Risk $ / Dollar Risk per Share

Example (XLE continued):

$1,000 / $3.60 = 277 shares

Round down for simplicity (e.g., 275 shares)

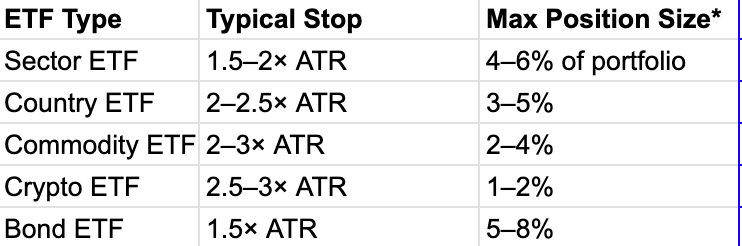

🛠️ Step 4: Asset Class-Specific Notes

📈 Sector ETFs (e.g., XLK, XLF, XLE, XLV)

Typically lower volatility

Can size up a bit more (e.g., stop at 1.5–2× ATR)

Often tied to macro themes (e.g., inflation = energy & financials)

🌍 Country ETFs (e.g., EEM, NORW, EWZ, FXI)

Currency risk adds volatility

Use wider stops (2–2.5× ATR)

Watch for geopolitical/liquidity-driven gaps

Great for relative strength trades

🌾 Commodity ETFs (e.g., GLD, SLV, DBC, WEAT)

Reflect physical commodity volatility

Check underlying future roll cost (in DBC, for example)

Natural Gas-focused ETFs (BOIL, UNG) can be extremely volatile → size small

₿ Crypto ETFs (e.g., BITO, IBIT, GBTC)

High volatility — use small position sizes

ATR stops often need to be 2.5–3×

Can be used for speculative trades or portfolio hedges

🧾 Bond ETFs (e.g., TLT, IEF, HYG, SHY)

Lower volatility → potentially larger size

But macro & rate risk matters — size based on current environment

Inflation expectations & Fed policy can cause unexpected gaps

🧩 Step 5: Portfolio-Level Adjustments

Cap exposure to correlated assets (e.g., don’t go max size in XLF and TLT simultaneously)

During high VIX environments, reduce size by 20–40% across the board

For leveraged ETFs (e.g., TQQQ, BOIL), halve normal position size

✅ Position Sizing Cheat Sheet

*Assumes you're risking ~1% per trade on a 1-3 month time frame. (My personal time frame is 5-8 months in our swing trading portfolio and 8-16 months in the long term portfolio)

🔁 Final Rules of Thumb

Volatility decides size. Not conviction.

Don’t normalize dollar value. Normalize risk.

Cut your size by 50% on highly correlated positions.

Let winners run. Cut losers by rule.

🗣️🧠 Understanding Correlation

We like to think of our portfolios like a well-balanced meal — a little of this, a little of that, and surely we’re protected if one thing goes wrong.

But in markets, relationships between assets aren’t fixed. They change. Sometimes slowly. Sometimes all at once.

Things that are supposed to balance each other — don’t.

Things that never moved together — suddenly do.

And just when you think you're diversified, you realize everything’s going down in sync.

That’s where understanding correlation becomes essential.

Not to predict what goes up next. But to understand how and why things move together — or apart.

Because the more you understand the relationships between the things you own, the less likely you are to be surprised by them.

Here are 3 steps to get there.

🧩 Step 1: Know What Correlation Measures

Correlation tells you how two assets move in relation to each other.

A +1.0 correlation means they move in sync

A -1.0 correlation means they move opposite

A 0 correlation means they move independently

Example: If SPY and QQQ have a correlation of +0.9, they’re likely to rise and fall together. If SPY and TLT have -0.6, when one zigs, the other often zags.

📊 Step 2: Use It to Manage Risk, Not Make Predictions

Correlation doesn’t predict direction — it measures relationship.

Two assets can both go down together or up together.

The goal isn’t to guess the next move — it’s to understand how combining assets affects your portfolio.

Diversification only works when the things you own don’t all react the same way at the same time.

🧠 Step 3: Correlation Changes Over Time

Correlation is not fixed. It moves with market conditions.

In times of stress (like market crashes), correlations often spike, even among assets that are normally unrelated.

That’s why tracking rolling correlation (e.g., 30-day, 60-day) helps you stay aware of how relationships are evolving — and why no hedge is permanent.

🧮 Position Sizing Resources

📘 Learn the Basics

Investopedia: Position Sizing Definition

https://www.investopedia.com/terms/p/positionsizing.aspBabyPips: Position Sizing Explained

https://www.babypips.com/learn/forex/position-sizing

📊 Calculators & Tools

Myfxbook Position Size Calculator

https://www.myfxbook.com/forex-calculators/position-sizeEarnForex Position Size Calculator

https://www.earnforex.com/tools/position-size-calculator/

🧠 Advanced Strategy Insights

Rayner Teo: How to Calculate Position Size Like a Pro

https://www.tradingwithrayner.com/position-sizing-formula/Option Alpha: The Ultimate Guide to Position Sizing

https://optionalpha.com/lessons/position-sizing

📈 Correlation Resources

📘 Core Concepts

Investopedia: Correlation in Finance

https://www.investopedia.com/terms/c/correlation.aspMorningstar: What Is Correlation and Why It Matters

https://www.morningstar.com/articles/1051875/what-is-correlation-and-why-does-it-matter

🔍 Visualization & Tools

Portfolio Visualizer: Asset Correlation Tool

https://www.portfoliovisualizer.com/asset-correlationsMacroMicro: Global Asset Correlations Dashboard

https://www.macromicro.me/charts/142/global-asset-correlations

🧠 Deep Dives

Fidelity: Understanding Correlation and Diversification

https://www.fidelity.com/learning-center/investment-products/mutual-funds/correlation-and-diversificationQuantInsti: Correlation in Algorithmic Trading

https://blog.quantinsti.com/correlation-algorithmic-trading/

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees: Help save the native bees! Learn more and get involved here.

Great post, and I totally agree. Position sizing is just as important as buy/sell. Everyone seems to focus on buy/sell, few discuss position sizing.

Thank you, what a great lesson again, printing this new article from the AAOResearch University to read it offline