Trump’s Inauguration Redux: A Dollar Sell Off on the Horizon?

“History Doesn't Repeat Itself, but It Often Rhymes”

In the lead up to Trump’s inauguration, the Dollar hovers at a pivotal juncture—one that could mirror its 2017 dollar sell off.

While shifts in bank cash levels and the Treasury’s balance signal renewed liquidity flows.

Bank cash levels took a hit around quarter end and they were dancing on their liquidity floor but then snapped right back in line.

On top of that, the Treasury’s cash account dipped under $700 billion, missing their usual $700 $850 billion buffer.

Maybe it’s just short term bond issuance stuff or a deliberate move to help with those quarter end strains.

Either way, when the Treasury runs its balance low, that money finds its way back into the system.

Excess funds will flow back into the reverse repo facility.

Treasury Leadership Shake Up

Scott Bessent’s taking the reins from Yellen. Sounds like he wants more long term notes and bonds, which might rein in liquidity a bit compared to Yellen’s heavy use of short term T bills.

That’s worth keeping an eye on but it won’t matter to us for awhile.

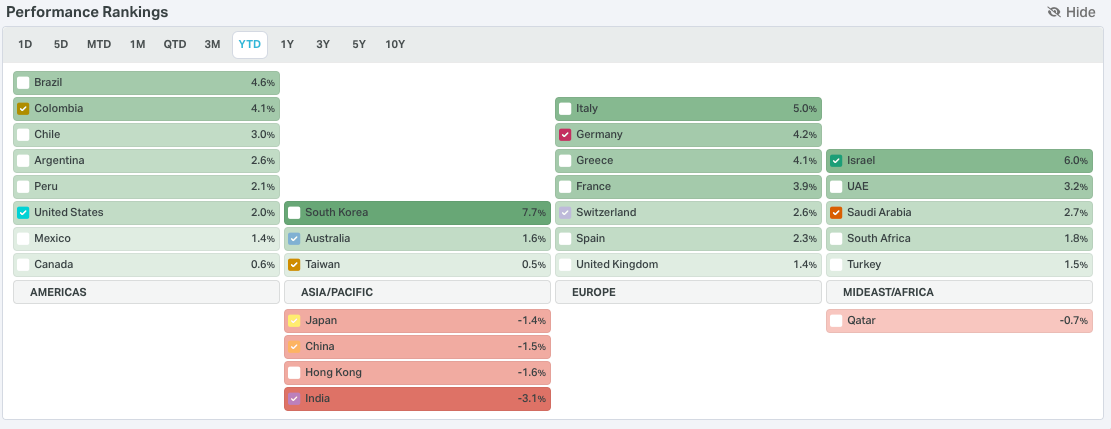

Global Liquidity Signals

The Dollar Index just tagged 110 last week, squeezing global liquidity.

It’s come off a bit after a cooler than expected CPI and today it is falling over 1%.

Nations with USD debt often have to dump U.S. Treasuries to keep their currencies from crashing. It looks like this is happening now!

Meanwhile, China’s USDCNY is pushing a critical level…

and bullish Euro positioning could move the currency higher and the dollar lower.

These are key pivot points for global liquidity.

The Structural Trade Deficit Issue

Being the world’s reserve currency is a double edged sword: great for finance and tech, not so great for domestic manufacturing.

The net international investment position of the United States is negative $24 trillion.

That basically means foreign ownership of our assets keeps going up, all because of these long standing trade deficits.

It’s a big structural challenge with plenty of economic and political angles to chew on.

Key Takeaways

Bank Cash Bounce: Quarter end dips reversed quickly, TGA still under target.

Bessent vs. Yellen: Longer Treasury durations might tighten liquidity.

Dollar Watch: 110 was a big test; cooler CPI eased pressure, but the dollar’s still the key.

Trade Deficits: Reserve currency perks come at the cost of manufacturing. The net international investment position of the United States is negative $24 trillion.