Weekly Portfolio Review: Winners, Losers, and New Trades

It has been a great year, now it is time to put our foot on the gas pedal! Shorts longs and more...

How I Grew My Account

The Question:

Mr. Rumplestiltskin, one of our founding members, asked how I built a six-figure trading account.

The Reality:

No, I didn’t bet the farm, sell my soul, or follow one flawless plan from the start. Actually, I began as a maniac, sizing every position at 100% of my account with max leverage. I hit $10k, lost it down to $2k, clawed back to $10k, then crashed to $1k.

The Turning Point:

In 2012-13, exhausted from the rollercoaster, I got desperate enough to change. I listened to experienced traders who preached that position sizing is everything.

What I Learned:

Small Positions, Wide Stops: Close stops mean blowing up in slow motion. I switched to smaller positions with roomier stops, a mantra I still live by.

Understand the Market Environment: I assess when to press forward and when to hold back.

Take Risks Carefully: When I sense opportunity, I up my risk—but only when my systems say to.

The Growth:

From disciplined grinding and catching outliers, I broke my $10k ceiling and more. By late 2016-2017, I hit six figures and haven’t looked back.

Key rule: I never take money out of my trading account. Every gain stays in to compound. (Some of you who have seen my account today always think it is amazing, however it took a long time to get there. You all can get there as well, it just takes time and focus.)

I don’t add money to my swing/position trading account. The money I make from other areas are invested in to retirements accounts, real estate, gold, businesses, crypto and more… (Some of you who have seen my account today always think it is amazing, however it took a long time to get there. You all can get there as well, it just takes time and focus.)

The Takaway: This stuff works but it is not a get rich quick scheme.

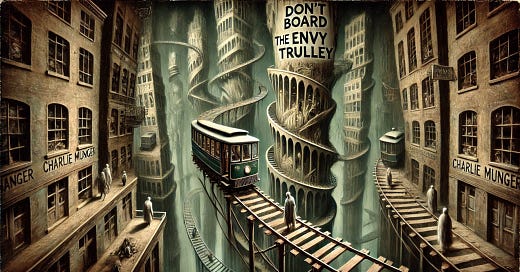

“Someone will always be getting richer faster than you. This is not a tragedy… The idea of caring that someone is making money faster than you are is one of the deadly sins. Envy is a really stupid sin because it’s the only one you could never possibly have any fun at. There’s a lot of pain and no fun. Why would you want to get on that trolley?” Charlie Munger

Today:

Up 30% in ETFs and over 50% in futures and we will keep grinding year after year through the good times and the bad times.

Trading isn’t about swinging for the fences daily, it’s about consistent, smart moves that let time work for you.