What Copper and Lumber Are Really Telling Us: New Trade Set Up

Why these materials may be forecasting the next leg of growth

Copper just hit a 52 week high. So did lumber.

Those aren’t just materials — they’re signals. The kind that don’t ring a bell, but quietly unlock a door.

International stocks are starting to hum. Not scream, not roar. Just hum — the way engines do before takeoff.

Momentum is funny like that. It never announces itself. It shows up in the corner of the room, minding its business, until one day it’s the only thing anyone talks about.

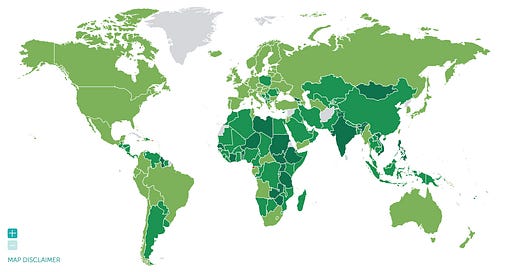

But here’s the kicker — this isn’t the usual kind of growth. It’s not the U.S. doing the heavy lifting. Not Europe either.

It’s the rest of the world.

Emerging and developing markets are growing at 4.2%. That’s more than double the 1.8% pace of advanced economies. Global growth is chugging along at 3.2%, and most investors still haven’t noticed who’s pulling the cart.

.

That matters. Because copper doesn’t follow the news — it front runs it. It’s not a reaction. It’s a tell.