What Hedge Fund Returns Really Look Like: What You Need to Know

Nasdaq, Dunn Capital, Spreadsheets, Probabilities, Systems, Silver, Bitcoin and Lean Hogs

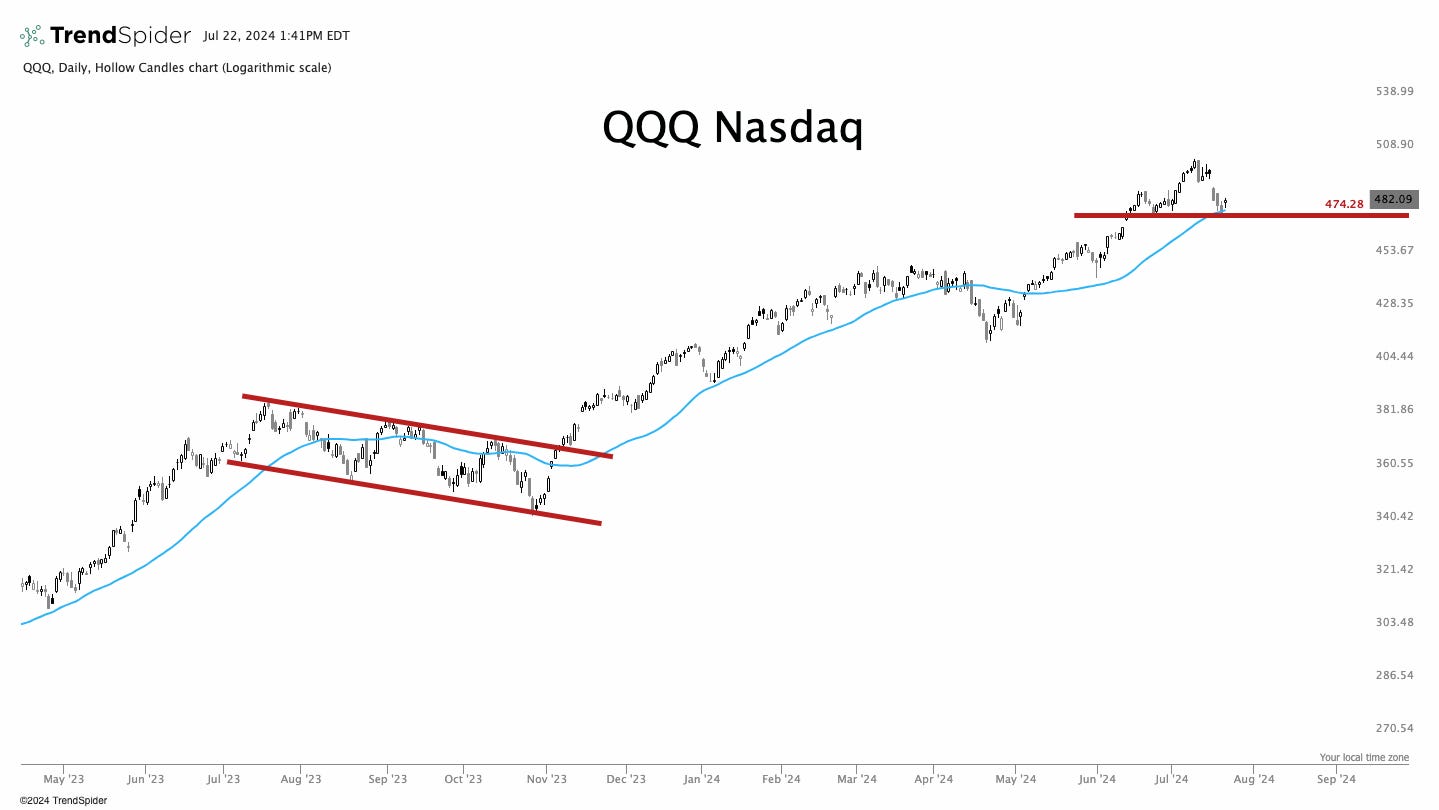

The Q’s are bouncing off of the 40 day MA. We also see that seasonality is usually strong in to the month end. The probabilities are on our side and that is the best we can hope for.

So, the first two weeks were good, the third week was down (that happened) and now we will rally in to the month end because I can see the future. Oh wait there is nothing predictive about trading markets. You can backtest, you can research, you can create new strategies and systems. You can also name you strategies cool things like predict it and so on and you will not have the ability to see the future.

What we can do is put the probabilities on our side. We can trade smaller. Have you ever seen a professional funds monthly returns?

I have seen this one updated many times. The first time I saw this was when they were in the middle of that 63% drawdown. It was one of the first times that I understood that even the best traders suffer drawdowns. Now I think someone is lying when they tell me that every week, month and quarter is green. It also shows you the power of compounding. 16% over 50 years is a lot more than 12%. So why is everyone shooting for 100% returns every year? IDK, because those stories are sexy and appealing. I also think it is necessary. Those 100% years can boost your returns for years. Also 100% returns are easier when you are running your own money and a lot less than a fund is usually running.

I want everyone to pay attention to this fund. There are huge years. There are also large multi year drawdowns just like the other fund. The amount of capital is much lower than Dunn so the volatility and returns can be much higher. Also know that these are professionals. If these really started at day one you would see some -99% drawdowns lol.

I don’t promise BS, I try to show you all that you can absolutely do this. I don’t want anyone to get upset or quit because they feel like they are not trading as well as everyone else. That is not true and everyones journey is different.

Trade small. Backtest. Use risk management and position sizing protocols and you will make a lot of money.

Good traders put the probabilities on their side and let the chips fall where they want.

You should have your own rules that you abide by. Fuck his rules and fuck my rules. Your personal rulebook.

If you enjoy the content, please like, share and subscribe to help the channel grow and keep this content available for others. This also helps to fund our media channel and get interviews with professionals for everyone to enjoy.