Energy-This was forwarded to me and I thought it was an interesting take. Eric Peters is the founder, CEO and CIO of One River Asset Management. With over $900 million in assets under management (AUM), One River focuses on thematic global investment opportunities.

By Eric Peters, CIO of One River Asset Management

“I tried to jump into the Potomac when I was young and my mother nearly killed me,” said the CIO.

“Now you could drink from our rivers if you had to, which is great, but the cleanup has meant everything is more expensive.”

The Environmental Protection Agency was founded in 1970 by Nixon to protect human health and the environment. We’re all better for it.

“Across an economy, we make both public and private investments. In the 1970s, we made big public investments.”

The returns accrue to society, but rarely to capital owners, and often at the expense of them.

“I would argue that the investments we made back then were good, but the tradeoffs we made included upward inflationary pressure and lower real rates of returns on private investments.”

The S&P 500 peaked in Nov 1968 and swung in a wild range through the 1970s, ending the decade unchanged in nominal terms.

In real terms, it lost roughly 50% of its value during that period.

From 1980 to present, the S&P 500 is roughly 42x higher in nominal terms and 10x higher in real terms (none of these returns include dividends). It’s been a great run for capital owners since 1980.

“The government will most likely continue to borrow and print to subsidize societal preferences for renewable energy and reliable supply chains,” he said.

“It is near-term uneconomic in that windmills and solar plants don’t cover their costs to private investors without federal subsidies. But they satisfy our collective preferences. They help insure us against risks we see geopolitically and environmentally,” he said.

“That’s why I see us headed into a 1970s-style inflation. Three, four, five percent inflation is probably where we’ll settle in.”

Anything above five percent tends to see equity multiple compression.

“It’s probably good for investors who measure their returns in nominal terms, but real returns will be lower looking forward, and inflation will continue to be tough for everyday people.”

I am not getting political here. This argument is tough for people. My point is that this was an objective way to look at this for us as market participants. At the end of the day we have to navigate and protect our accounts for our friends, clients and most importantly our families. What this means for the macro environment is the only thing I am trying to pay attention to.

Any way we look at it the overheating period is the primary driver of market tops. We are not there yet according to my models but we are getting to that phase in the cycle. Right now we are starting to overheat and if we cut rates this year, we will absolutely overheat! Inflation would be out of control if that happens.

Excess generally causes reaction, and produces a change in the opposite direction, whether it be in the seasons, or in individuals, or in governments.

Plato

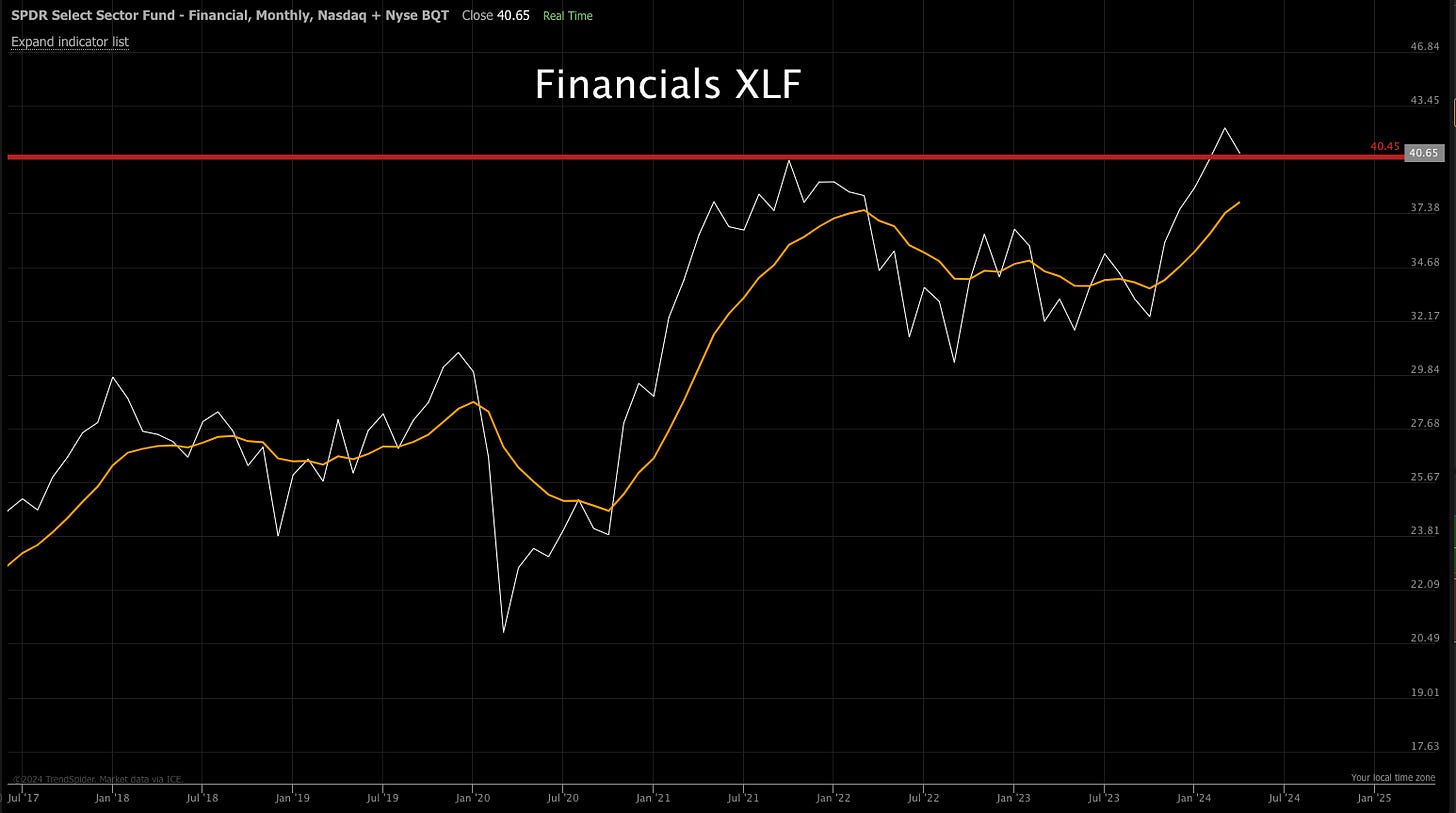

Financials