Wheat, Poland, Chile: Three Players in One Global Story

Explore Our Holdings, New Positions, and YTD Returns

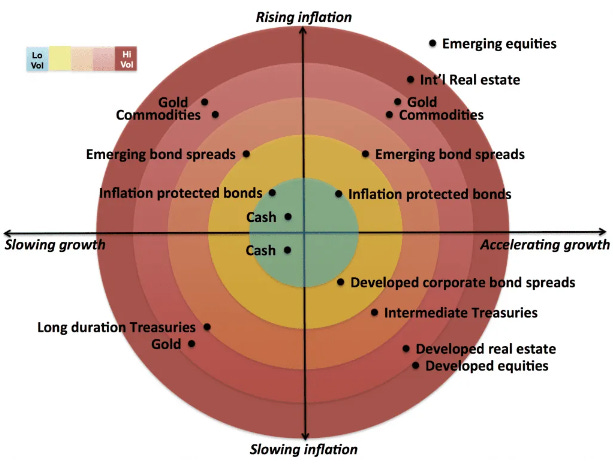

One of the most valuable tools I use in my global macro research is my regime model which I modeled from Merrill Lynch and Ray Dalio.

This is from Ray, this was in a leaked note from him in the early 2010s.

It’s a simple yet powerful framework for understanding the stages of the business cycle and how different asset classes perform in each phase.

Think of it as a map for navigating markets.

The first one built was the Equity Clock by ML. Here it is in all its glory.

The regime model has four phases: Goldilocks, Reflation, Stagflation, and Deflation.

Each phase is defined by whether growth and inflation are above or below trend.

My contribution was basing those inputs on their respective rates of change.

Understanding where the economy is at on the model helps identify which assets to own and when.

Bonds thrive in Deflation. Stocks outperform in Goldilocks. Commodity sectors dominate in Reflation. And in Stagflation cash and commodities are king.

I feel like this is what separates me from other traders.

I follow the regime model for what assets I should be looking at.

I also have price action in the regime model which over rides the fundamental model.

But the price action is saying the same thing…

Here is what the model is saying…

👇