Why Bonds Are Trash and Commodities Are Just Getting Started-Market Reflections

Gold Miners, Energy, and Materials: The Sectors Leading the Reflation Trade

Trading is a game of grit. But grit doesn’t come from pretending to be fearless or perfect—it comes from confronting the parts of yourself you’d rather ignore.

The doubts. The greed. The fear.

The side of you that you wish didn’t exist but that you can’t escape.

Carl Jung called it the shadow self. It’s the part of you that you repress, the part that you’re afraid to acknowledge.

But here’s the thing: the traders who reach greatness are the ones who embrace their shadow, not run from it.

Think about Fight Club. Tyler Durden wasn’t just a character—he was an archetype of the shadow self. He challenged the narrator to stop living in denial and start owning the raw, unfiltered truth of who he was.

That’s what trading demands of you.

You’re not just fighting the market—you’re fighting yourself.

Every trade, every decision, every stop loss is a battle between your shadow and your higher self. Your shadow wants instant gratification. It wants revenge trades and oversized positions.

But your higher self?

It knows the truth: discipline and patience win the game.

The secret is to stop pretending the shadow isn’t there. Instead, use it. Channel it.

When you feel fear, let it remind you to follow your risk management plan. (The one you made before you got in to the trade.)

When you feel greed or euphoria, let it remind you that markets go up and they go down and not to get too high or low about it.

When you feel doubt, understand that nothing good comes easy.

Keep fucking going.

You don’t overcome your shadow by silencing it.

You overcome it by understanding it and turning its energy into your strength.

Just dropped two new videos today—one with Kevin Muir, aka The Macro Tourist, and the other on The Holy Macro Show.

Do yourself a favor and watch them. Seriously. We covered everything I’ve been ranting about lately, and Kevin absolutely nailed it.

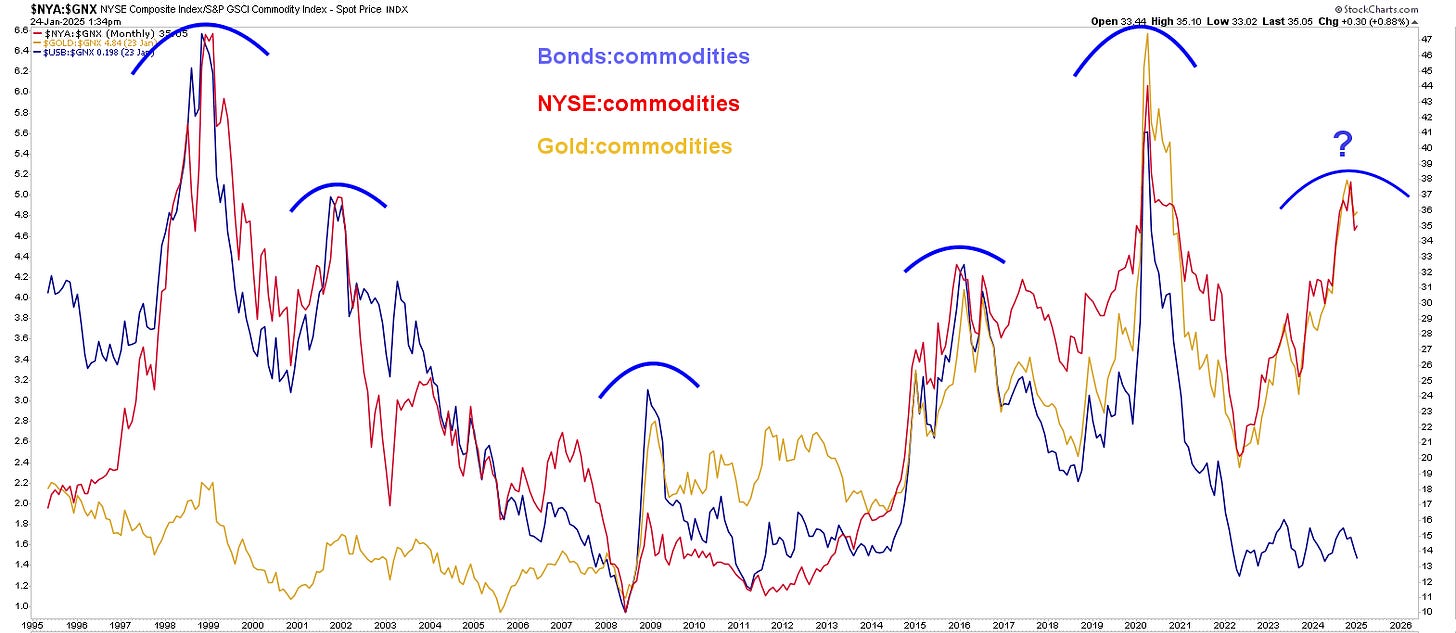

Here’s the deal: we’re both seeing the same landscape ahead. Bonds? Still trash. Commodities? They’re starting to outperform everything. And it’s not just noise—it’s where the money’s flowing at the start of the year. Historically, that trend doesn’t just fizzle out.

Kevin Muir made a great point on the show: there’s always a price where investors start thinking, “Yeah, I don’t want to be in this anymore.” And right now, that seems to be happening with stocks.

Broadly speaking, it looks like they’re saying, “Nah, I’m good.”

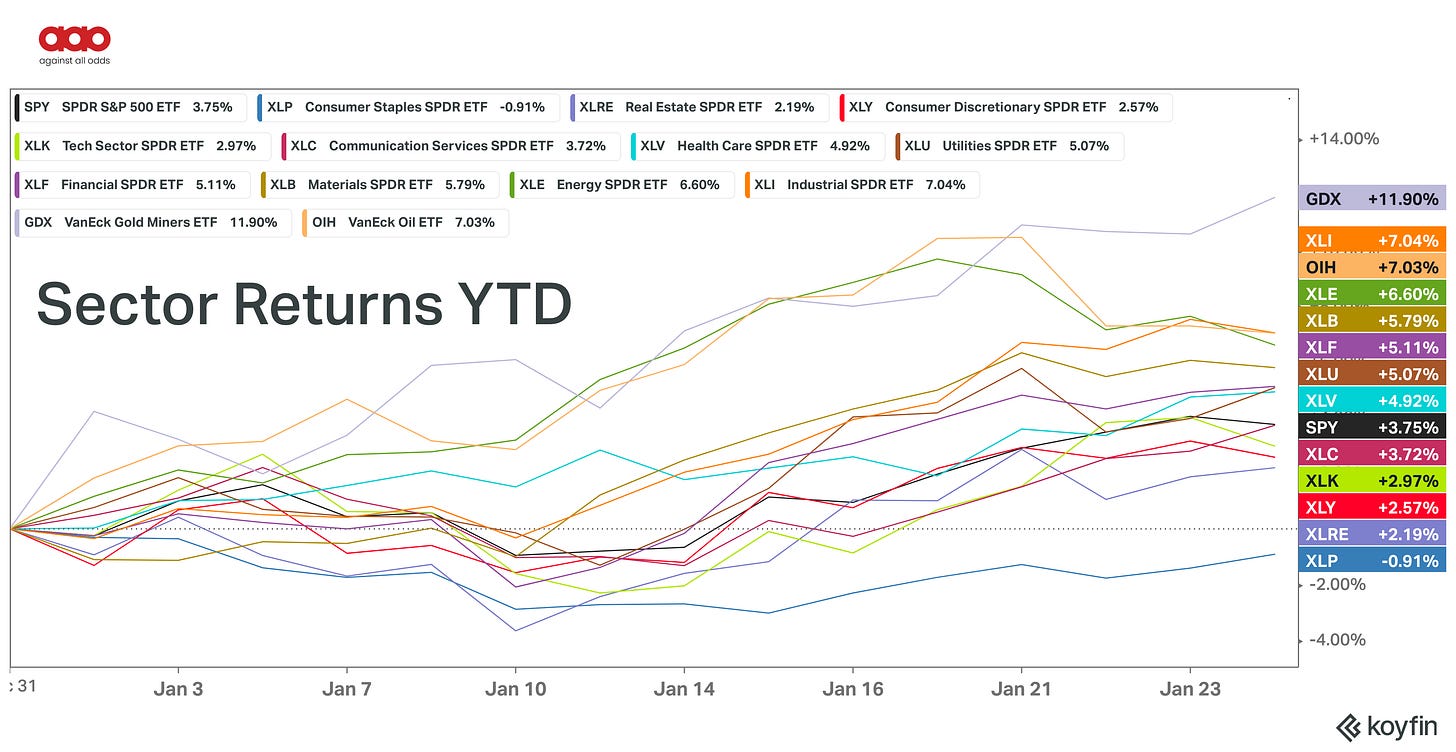

But you know what they do want? Gold miners, industrials, energy, materials, financials.

It’s called the reflation trade. You know, the thing I haven’t shut up about for months? Yeah, that. Sorry, not sorry.

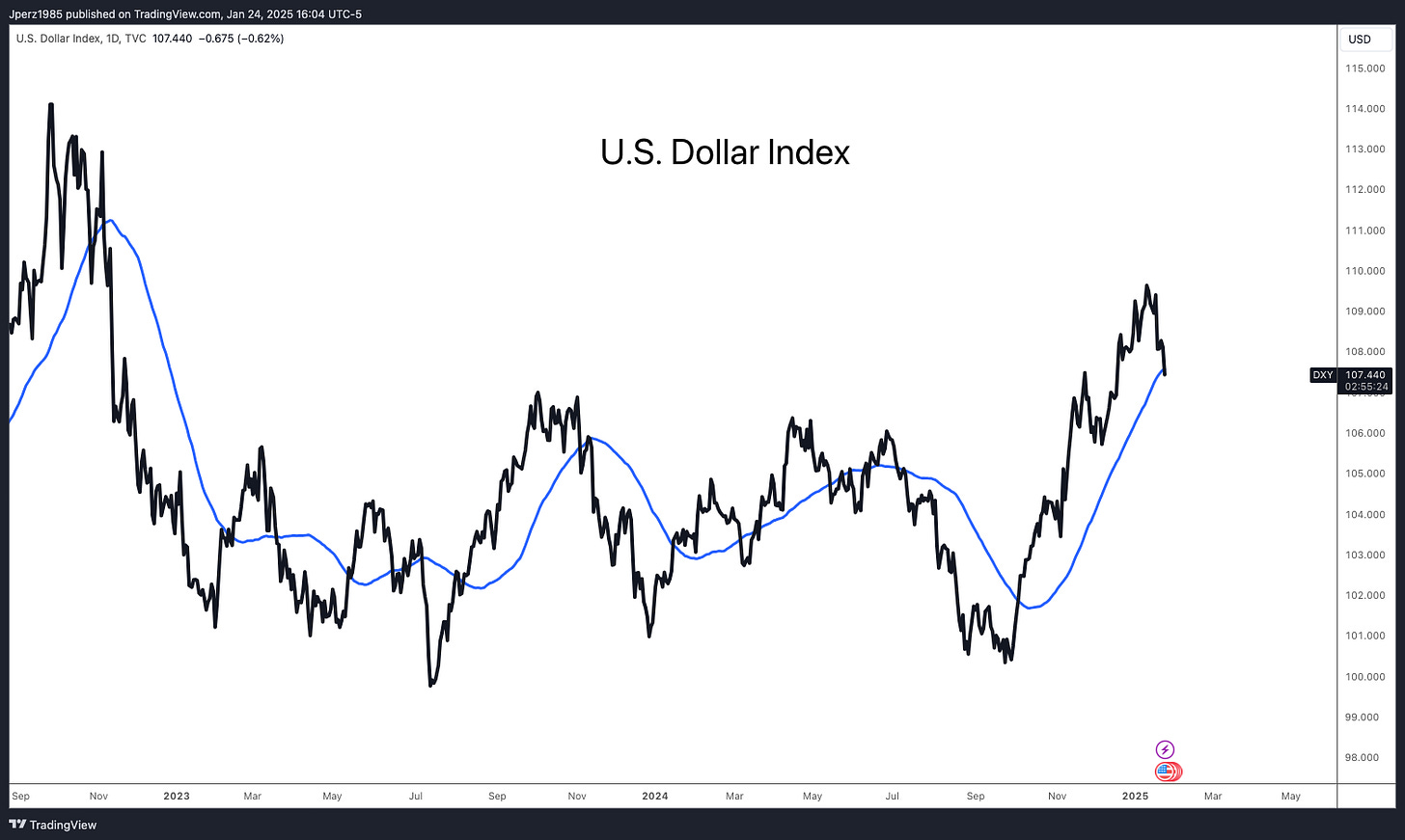

And the dollar?

That’s going to take this trade to the next level.

It took a hit this week and closed below its 50 day moving average. That’s a big deal.

The dollar will take this trade to the next level. Read about how the dollar effects the markets here.

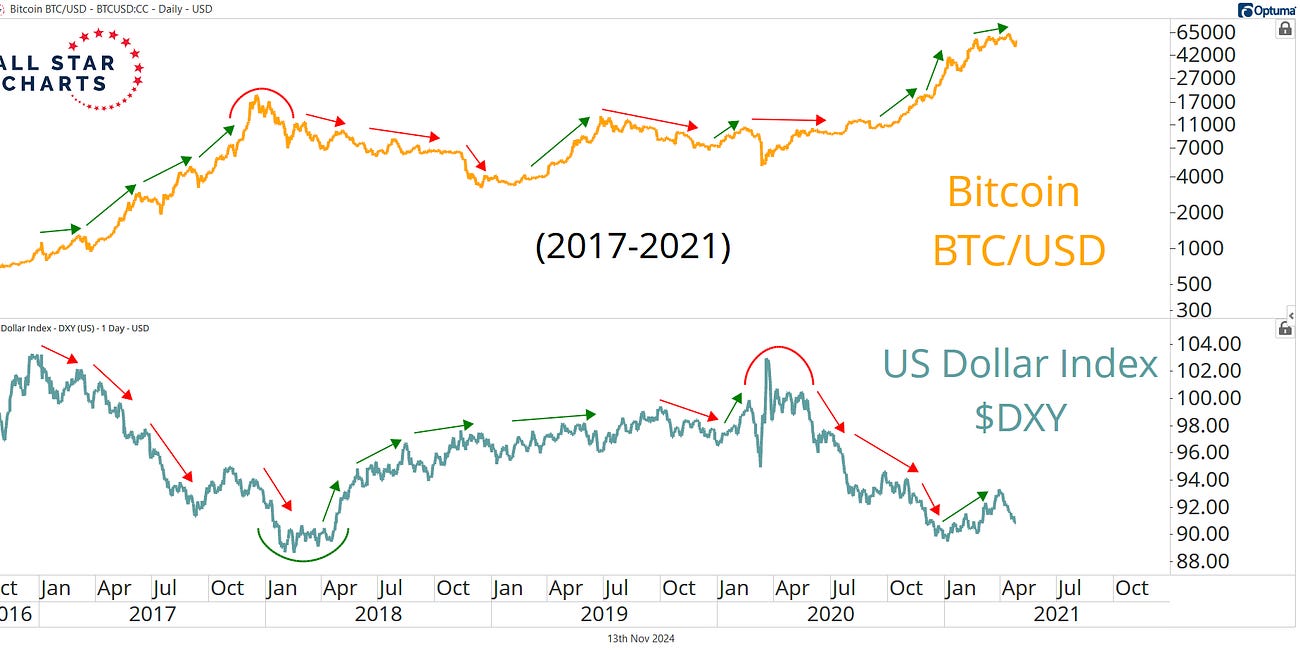

How to get Bitcoin to 1 Million...

Bitcoin is my go-to indicator for understanding risk on/risk off trends.

The dollar drives everything.

Want proof?

Check out this ratio—it trends with the dollar most of the time, for obvious reasons.

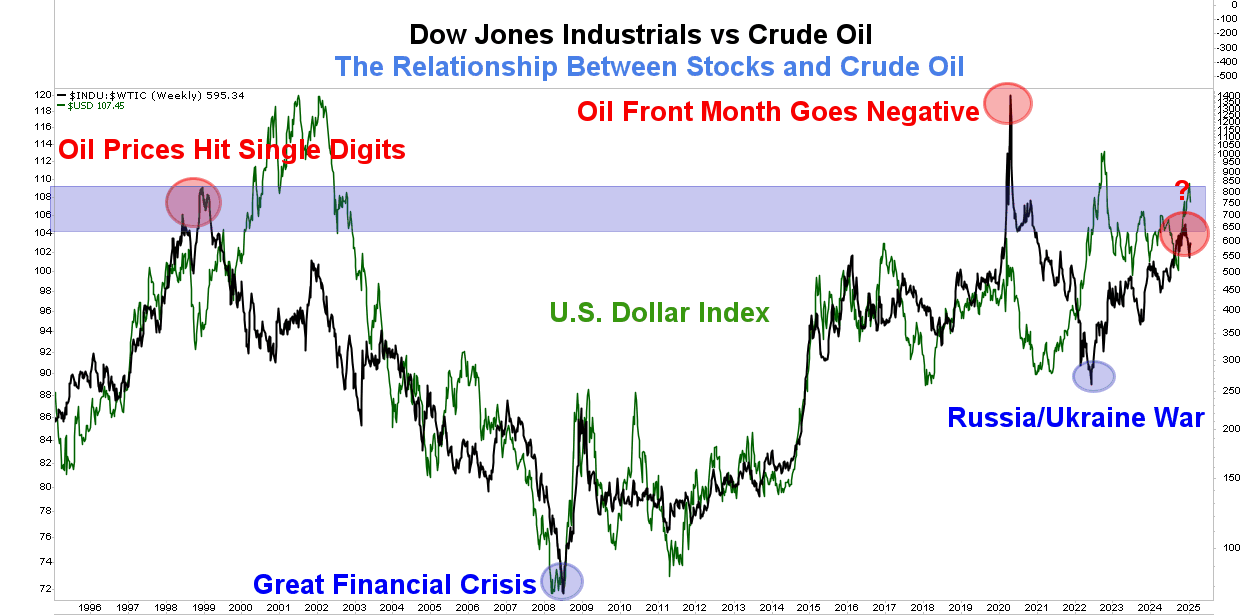

What blows my mind is this: the last time this ratio hit the blue line, oil had to go negative. This time? Oil only had to drop to $65. What does that tell you? The commodity super cycle is alive and well.

Here’s what I’m holding: currencies against the dollar, gold, silver, miners, bitcoin, and commodity heavy sectors and countries.

Sometimes it’s just that simple. Trade what’s in front of you—not what you wish the market would be.

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees: Help save the native bees! Learn more and get involved here.