Yields, Rotations, and the January Trifecta: Profiting from the Next Big Move/Month End Portfolio Review

Why rising yields aren’t the end of the market—they’re the beginning of a major rotation into value, commodities, and inflation plays.

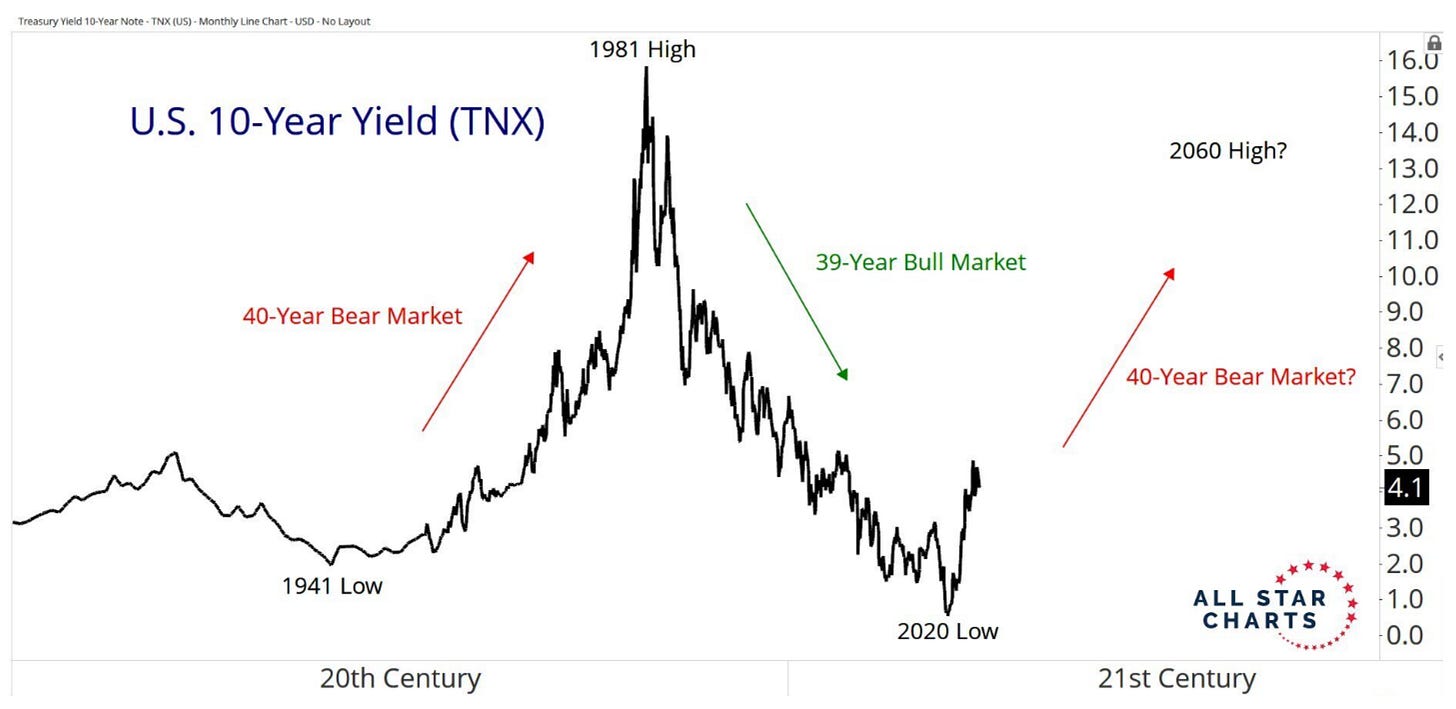

40 years up, 39 years down. Yields could go way higher than most people even think possible.

And yet, everyone keeps saying, “They can’t go much higher because of this, that, and the other thing.” But the truth? 5% is the average but with this amount of debt, it’s concerning.

📌 1980: ~12.4%

📌 1990: ~8.1%

📌 2000: ~5.1%

📌 2010: ~3.3%

📌 2020: ~0.9%

📌 Today: 4.54%

So does that mean all stocks get hammered as yields rise? Not exactly. What’s more likely is a continued rotation into value based sectors because of valuations.

People look at this scenario and think the market is about to crash. Sure, anything is possible.

But what I see? Opportunity.

It is the same setup as the Nifty 50 stocks in the ‘60s, the Dot-Com Bubble, and post-COVID.

And what happened every single time?

🚀 A rotation into value, commodities, gold, and cyclicals.

Now, check this chart—gold moves every time we hit these types of valuations. And silver? It might underperform for a while, but when it moves, it rips.

On this chart you see gold makes a move every time we see those types of valuations. Also you see silver might underperform for awhile and then it outperforms.

This is something that I will keep a watch on all year long.

The moves to start the year told me that we are positioned correctly.

As January so goes the year and we are positioned in the strongest asset classes and sectors.

And we hit the January Trifecta.

✅ Santa Claus Rally

✅ First 5 Days

✅ January Barometer

The market is setting up perfectly for another inflation driven move.

Buckle up.