“ Having a beautiful idea doesn’t get you very far if you don’t do it the right way.” Colm O’Shea

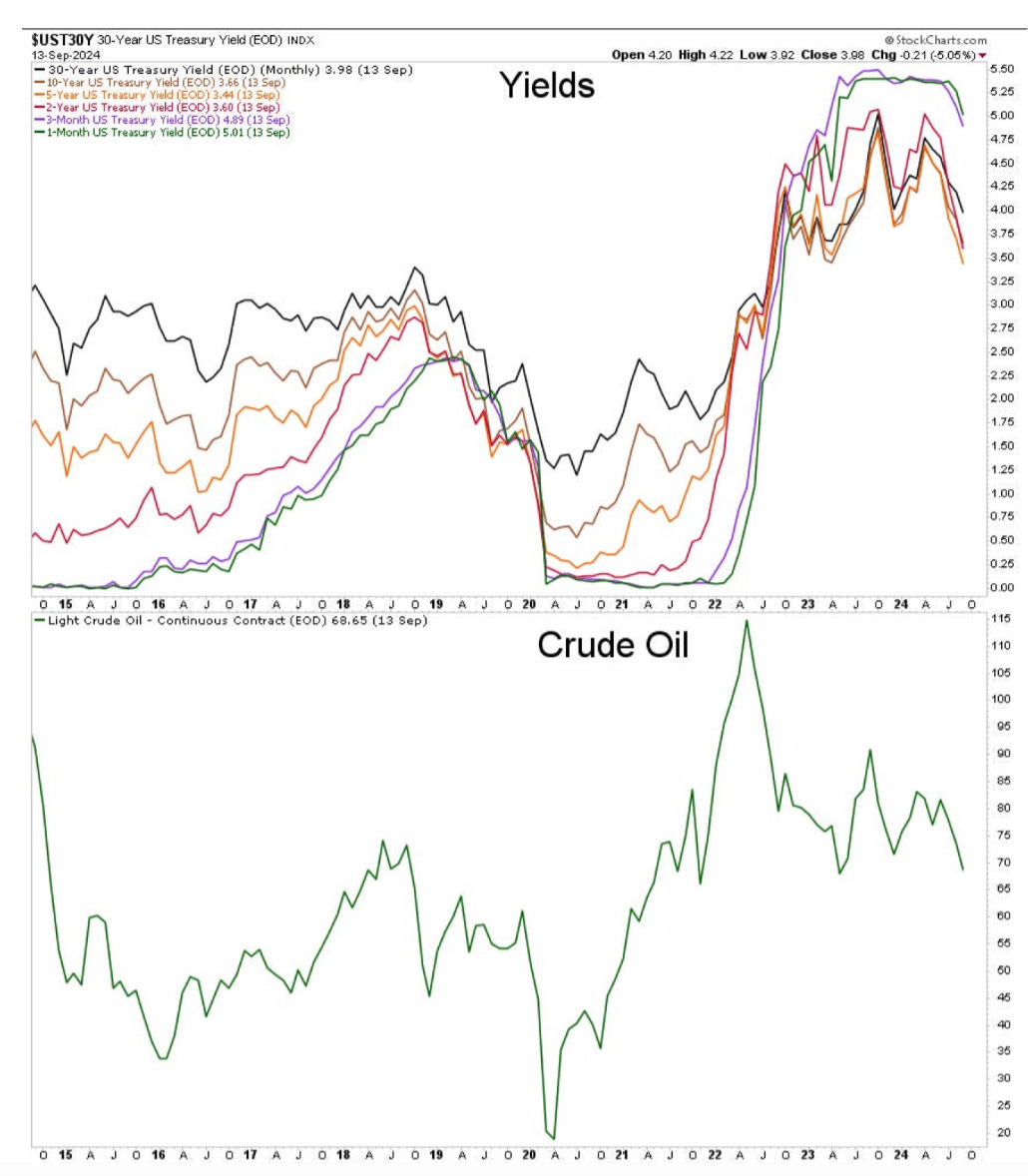

When inflation or growth is on the rise, central banks often raise interest rates to control it. When inflation or growth is falling, central banks lower interest rates to stimulate the economy.

This makes everything seem so damn simple when it is not.

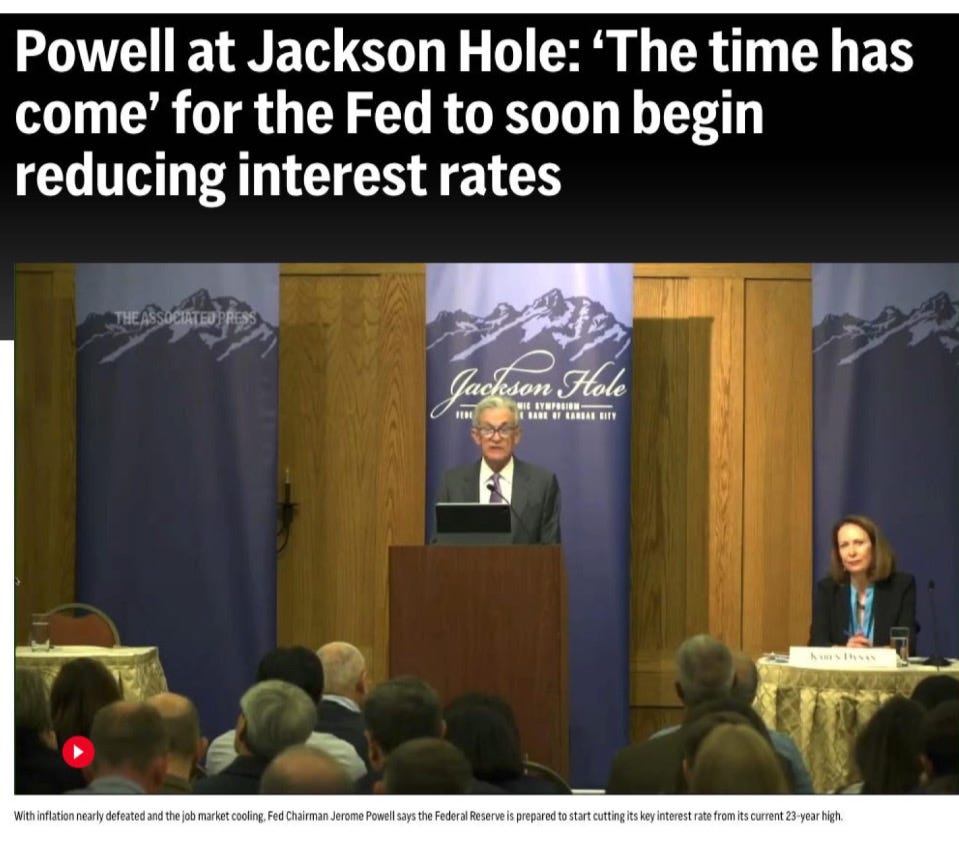

As traders, we need to understand what the central banks are doing and completely disregard what they are saying. Remember when inflation was transitory at the end of 2020 through the beginning of 2022.

This led to years of inflation and a lot of money that was made in the commodity market. We had a 179% return in 2021. Thankfully we did not listen to the Fed…

Read the fine print. “With inflation nearly defeated…”

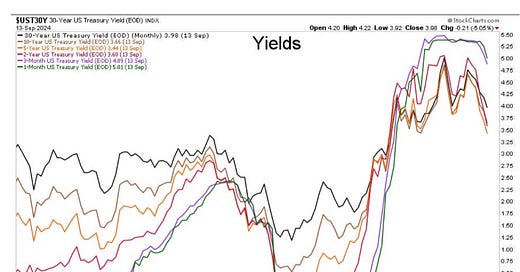

Inflation is right under the surface. Yes, at the moment I am long bonds for a trade. I will always follow my signals above all else.

My big picture view is that inflation will come back with vengeance if they start cutting rates rapidly.

The Fed rate probabilities continue to rise towards a 50bps cut as the week at the meeting gets closer. This could lead to higher equities, reflationary assets like financials, industrials and oil prices.

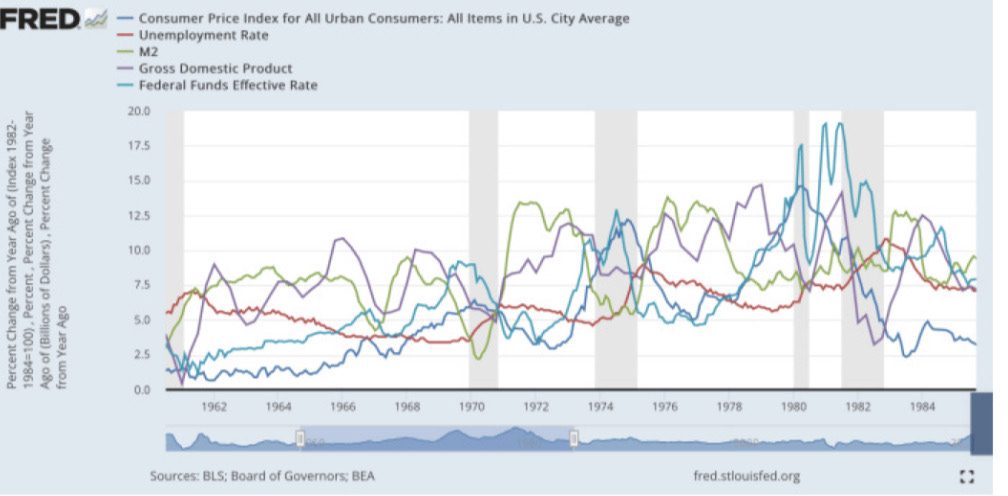

There are a few periods in history that we could compare this to. 1933 and the Nixon Shock in 71.

In 2020 we did not confiscate gold like we did in 1933 or get off of the gold standard like we did during the Nixon Shock. During the Covid Crash we dumped a ton of liquidity into the market and it is just waiting on the sidelines.

Looking at the 70s we can see that the Fed constantly gets behind the curve.

The name of the game is to do as they do and not as they say. So we are long bonds but I am saying that this could be short lived and I would stay open to taking buy signals in the commodities market.

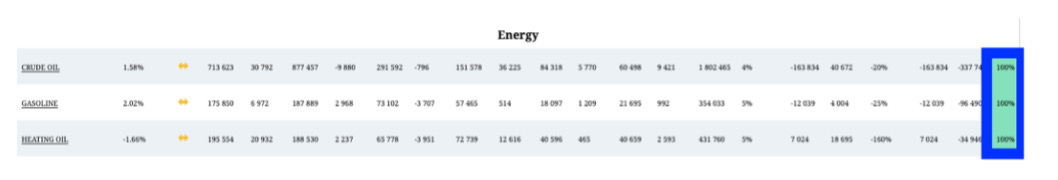

Oil will tell us when we need to dump bonds. Positioning in energy futures is extreme, we could see a possible bottom right here, right now.

For now let’s continue to pay attention to oil for a signal.

If we are headed into a recession and bond prices are going to continue higher, oil will break below 60 quickly. If I am right and oil is going to start showing strength. I think oil will hold in this 70-85 range.

Then we will wait for inflation to show its ugly face.