Gold’s Best Week, BTC’s Big Move, and Lessons in Conviction

Weekly reflections on the market. Bonds, crypto, corn, energy, futures, J Pow and more...

How is it going?

Gold is having its best week in over a year. On Monday I put out a post to buy the dip.

Bitcoin surged to $100k after AAO Research called it the best election trade.

Energy stocks, banks, small caps, coffee, cocoa, and orange juice are hitting new highs.

The Lesson:

Success isn’t about boasting. it’s about building a methodology and sticking to it.

Here’s the deal:

Don’t let politics, opinions, or noise dictate your trades.

Whether it’s price action, fundamentals, or even moon phases—commit to your strategy.

Once you’re in, stick to your exit plan, not someone else’s opinion.

True Conviction:

It’s not what TV pundits preach. Conviction is following your strategy with unwavering confidence because you know it inside and out.

Want to trade like a pro? Learn your methodology. Trust your trading plan. Then stick to your strategy.

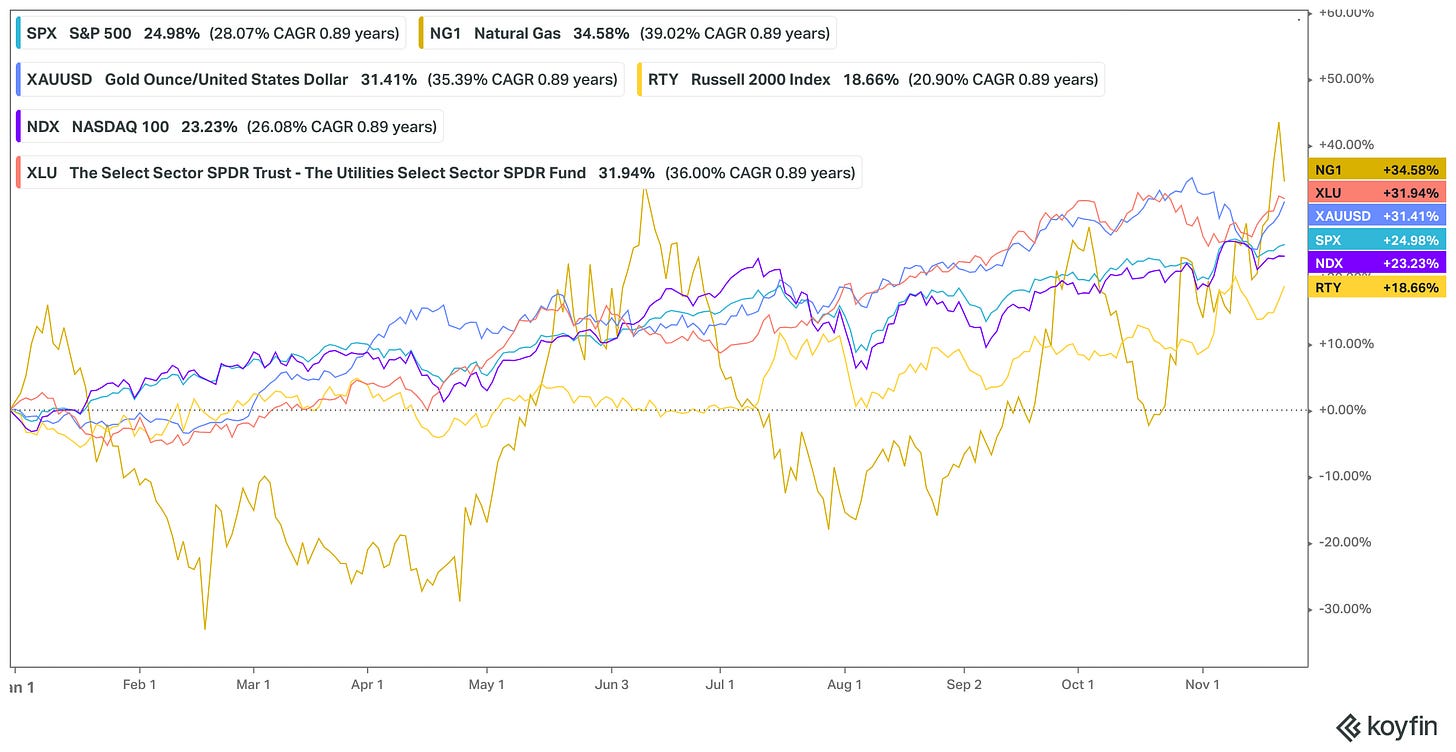

Futures-3 months.

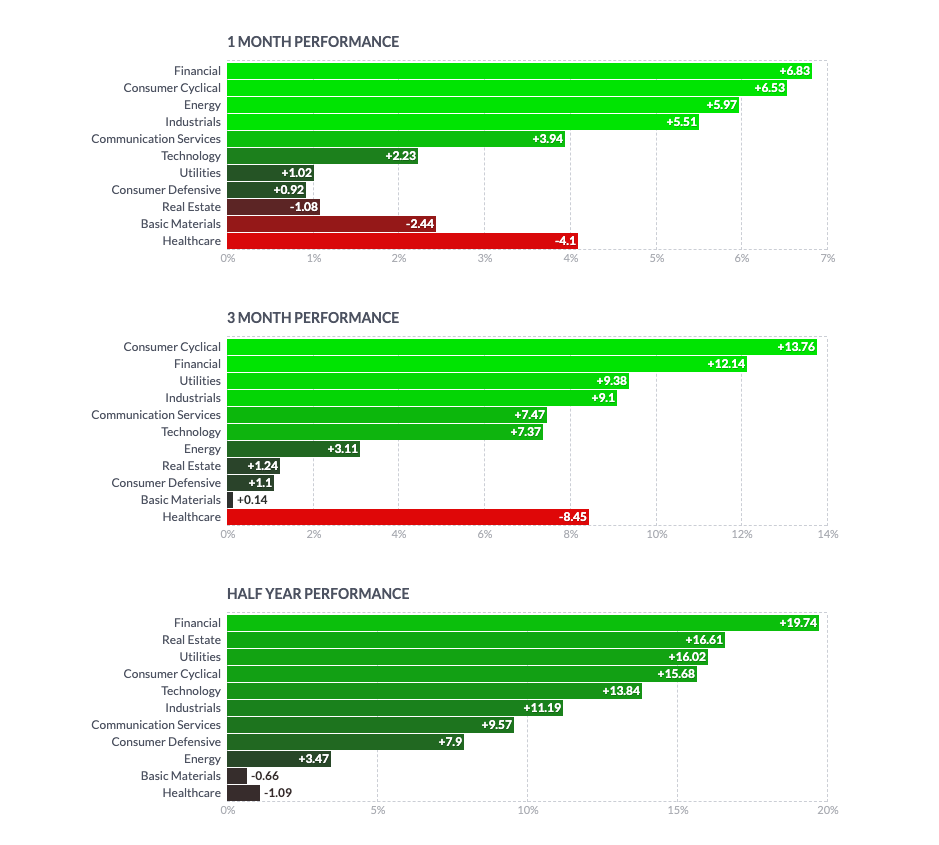

Sectors-1 month, 3 month and 6 month time frame.

-J Pow is the new Wolf of Wall Street!

Natural Gas is on a tear, outperforming nearly everything. AAO's reversal model has been long since 8/12, and as of earlier this week, our trend system is on board too.

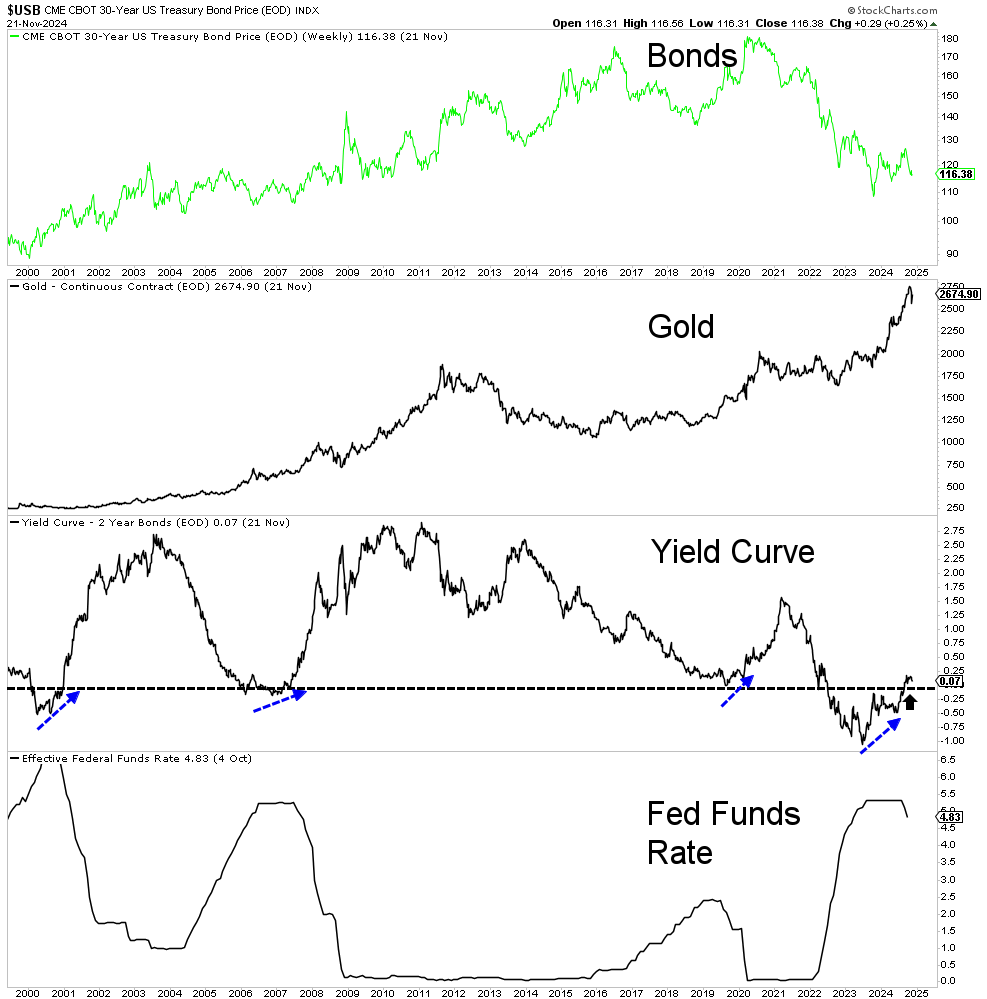

A few months ago, markets expected over 100bps of rate cuts. Now? The spread between the 2-year yield and the Fed funds rate is down to 50bps. That’s a dramatic pivot.

Despite a rate cut in September, interest rates have actually risen. The Fed may need to pump the brakes on more cuts sooner than expected. I still see another rate cut or two ahead.

NYSE-New highs vs. New Lows. A sign of strength.

It is still in a good environment for gold? Yes, it is. Hold positions, buy dips and ride the trend, till then end, when it bends.

Corn (Price: Yellow line) is making it’s first 100 day (20 week pictured: Gray area indicator) high and it it closed over the 50 week moving average (blue line) today.

A new commodity regime is coming. If gold is saying anything, it is saying that the commodity cycle will start up some time soon.

The Bull/Bear Indicator is telling us to stay long.

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees: Help save the native bees! Learn more and get involved here.

There will be no more inflation! We'll simply sell off the US gold reserves to buy bitcoin and pay off the national debt! Works 100% of the time guaranteed profit! https://www.lummis.senate.gov/press-releases/lummis-introduces-strategic-bitcoin-reserve-legislation/