New All Time Highs, Geopolitical Risk: The Seven Day Scope: Snipers Only-Free Weekly Report

Commodities, Gold, Equities, Bonds, Currencies and more. Welcome to our free weekly report available every Friday.

📈 Jump into the world of market analysis with me. In this episode, we're gearing up for an intense exploration of market dynamics, trends, and the strategies that matter most. Get ready for a laser-focused perspective on the ever-evolving financial landscape. Let's navigate the chaos and find clarity together. Welcome to The Weekly Scope!

Let’s see what we can see in our sights this week!

1. SPY-Hold your longs and ride the trend.

Intermediate trend level 453: Primary trend level 438

The double top charts are rampant! This will probably get to new highs soon. We hit new highs as I was writing this :).

3. Oil-Looking at this chart. I still see that a catalyst is coming.

4. People love buying losers. Stay away from China.

5. Buying it will not make it go up. Wait for it to bottom. Please!

My personal favorite from Bruce Kovner and it illustrates my feelings on this:

Is that to say that virtually every position you take has a fundamental reason behind it?I think that is a fair statement. But I would add that technical analysis can often clarify the fundamental 29 picture. I will give you an example. During the past six months, I had good arguments for the Canadian dollar going down, and good arguments for the Canadian dollar going up. It was unclear to me which interpretation was correct. If you had put a gun to my head and forced me to choose a market direction, I probably would have said "down." Then the U.S./Canadian trade pact was announced, which changed the entire picture, hi fact, the market had broken out on the upside a few days earlier, as the negotiations were finishing up. At that inSant, I felt completely comfortable saying that one of the major pieces ii the valuation of the Canadian dollar had just changed, and the marlet had already voted. Prior to the agreement, I felt the Canadian dollar was at the top of a hill, and I wasn't sure whether it was going to roll backwards or forwards. When the market moved, I was prepared to go with that movement because we had a conjunction of two important element!: a major change in fundamentals (although, I wasn't smart enough to know in which direction it would impact the market), and a technical price breakout on the upside.

What do you mean you weren't smart enough to know in which direction the trade pact announcement would move the market? Since U.S./Canadian trade is so much a larger component of Canadian trade than it is of U.S. trade, wouldn't it hive been logical to assume that the trade pact would be bullish for the Canadian dollar?

It didn't have to happen that way. I could just as easily have argued that the trade pact was negative for the Canadian dollar because tie elimination of the trade barriers would allow imports from the Ш. to submerge Canadian interests. There are still some analysts who adhere to that argument. My point is that there are well-informed traders who know much more than I do. I simply put things together. They knew which way to go, and they voted in the marketplace by buying Canadian dollars.

I really, really think something is going on. Either china will side with Iran or something… The price action always tells us something if we are open to listening to it.

The old quote comes to mind “Show me the price and I will show you the news.”China would have to get involved. Either they get involved if this escalates further or this gets resolved quickly. What would you bet on? For our paid subscribers we are expressing that trade in a low risk way. Either way. Say away from China and get ready for prices to possibly rise.

6. With all the turmoil in 23 and 24 we still are nowhere near a sell signal in our primary trend models as the market hits new all time highs. I sounded crazy for talking about this and then doubling down in November.Random Reflections: Random thoughts on why the market will make new highs.

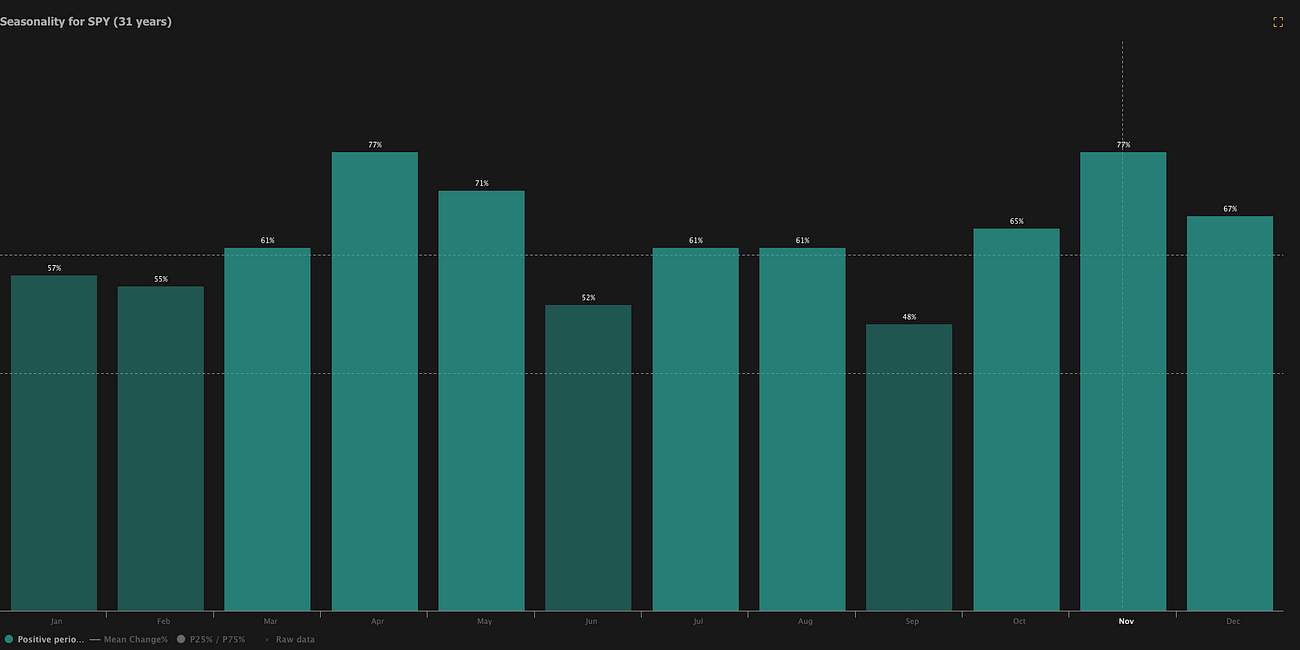

·SPY seasonality… The holidays can be very bullish. 77% of November’s returns over the last 31 years have had positive returns. A loss never bothers me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does damage to the pocketbook and to the soul.

Here we are…

7. IGV- Beautiful chart structure. Showing relative strength and as these hardware companies move in to software we may see this sub sector continue to outperform.

8. Cocoa-This is why we don’t guess at exits.9. Semiconductors- They keep moving!

10. Long term signals are still bullish.

11. Bitcoin-A close under 38k and we are out!

Stay informed. Stay resilient. Against all odds.

Warm regards, Jason Perz

If you find this content valuable, please consider liking, sharing, and subscribing. Feel free to pass it along if you think it can benefit others.

YouTube: @againstalloddsresearch https://www.youtube.com/channel/UCLvDNCnhNQbQnABUSFbwagg

Twitter: @jasonp138

Substack: aaoresearch.substack.com

Against All Odds Research

jperz1985@icloud.com

Also I will host a zoom group to discuss or just general Q & A on Friday January 26th. It will be recorded and put on YouTube.Jason's Odds is inviting you to a scheduled Zoom meeting.

Topic: AAO General Market Talk

Time: Jan 26, 2024 02:00 PM Eastern Time (US and Canada)

Join Zoom Meeting

https://us06web.zoom.us/j/88182220671?pwd=4BxHbMMCRZsJ4PTZMmPiv9Z797903I.1

Meeting ID: 881 8222 0671

Oh also don't forget about INDA because big tech sends them a lot of work

Some nice US software is much better I agree. 🙂 They are all very busy currently finding some ways to build AI into existing apps and that is going to drive subs.