🔍 Quad Witching = Clarity (Eventually)

The shakeout is the signal. When it’s over, real opportunity emerges.

When you’re driving across the country, the possibilities are endless.

You stumble into beautiful places by accident.

Then you go home, grab your girl, and head back to share that experience. It’s spontaneous. It’s real.

One time I blew a tire and ended up next to a lake in the middle of Iowa—one of the most peaceful places I’ve ever seen.

You make friends on those trips. The kind of people who become part of your story. You might not talk every day, but when you see them again, you light up. (I’m terrible at smiling in pictures, by the way. I usually have to tell people I am smiling. And yes, I know—my hair looks great.)

You travel across the world to compete. To push yourself. And when it’s over, the people you were battling against? They become family.

Because in the end you were only battling yourself.

There are moments when it all clicks. You’re filled with purpose, drive, and satisfaction. And then there are the other days—when you’re running on an hour of sleep, trying to make it to the next stop, slowly losing your mind in the front seat of a truck.

But here’s the thing: it’s only in uncertainty that we find ourselves.

That’s true in life. It’s just as true in markets.

Right now, uncertainty is wrecking most traders. They want certainty in an environment that has none. That’s where they go wrong.

Not us.

We’ve caught 3x-8x options winners in the precious metals space. Why? Because gold loves uncertainty. It thrives when nothing else makes sense.

And let’s be honest—what has been certain this year? Nothing. Not inflation. Not yields. Not the Fed. Nothing.

That’s why you stop chasing certainty. You focus on probability.

That’s where relative strength and momentum come in. These tools aren’t about predicting. They’re about positioning.

The core idea? What’s strong tends to stay strong. What’s moving tends to keep moving. Like Newton’s law—an object in motion stays in motion.

So ask yourself: Where is capital flowing when everything feels chaotic?

Here’s a list of every international ETF that’s outperforming the S&P 500.

This is what leadership looks like.

This is real rotation. It’s fast. It’s global. And it’s happening because of one thing: the dollar.

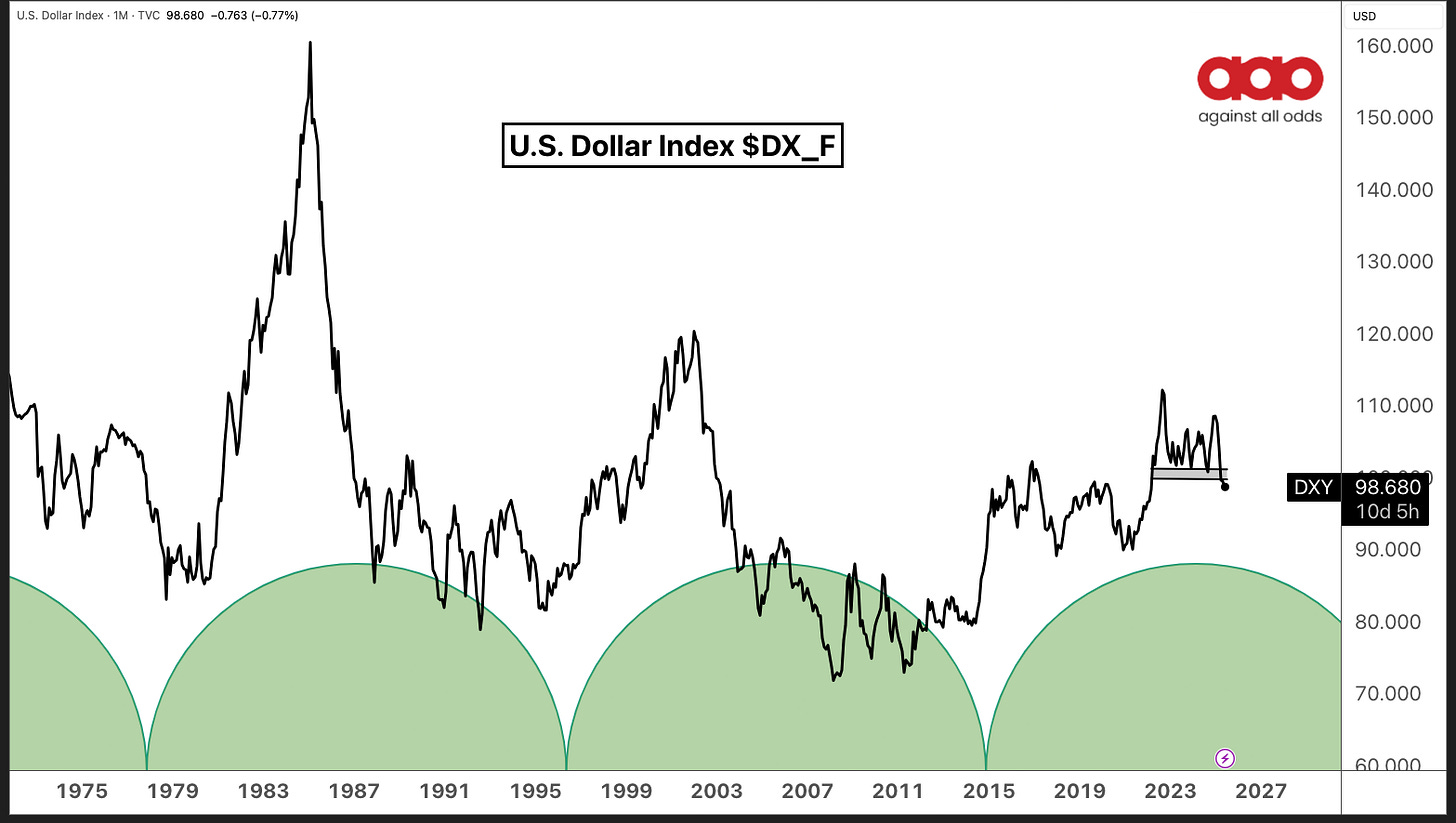

As the dollar keeps slipping, capital is moving where it’s treated best—outside the U.S. The dollar cycle chart shows you when we should be looking for a lower dollar.

And when a trend is in motion, I don’t argue with it. I follow it.

The dollar has been screaming at traders for months: gold, silver, miners, international stocks, commodities—they’re ready. And now, they’re moving.

We’ve stayed long the reflationary theme and it’s paying off—with real returns and real leadership.

Now take a look at the Macro Trend Scan: international equities are dominating. Commodities—from natural gas to oil, gasoline, and copper—are catching up fast.

Use this scan to get precise. To find where you want to be.

Because in markets, uncertainty doesn’t have to be a weakness.

If you let it, it can be the most powerful edge you have.

Uncertainty forces you to focus. To adapt. To move with price, not against it.

Most traders freeze when things get unpredictable. We don’t.

We lean into it.

Because when you stop fearing uncertainty, you start finding opportunity.

The Witch is Here

Quad witching happens four times a year when stock index futures, stock index options, single stock options, and single stock futures all expire on the same day.

It’s basically the market's version of controlled chaos.

Liquidity spikes. Volume surges. And price gets whipped around like crazy—especially near the close.

Most traders get chopped up in the noise. They overtrade, misread the moves, and get shaken out.

But here’s the thing no one tells you—quad witching often marks key market lows.

Why? Because forced rebalancing and dealer flows create temporary volatility that clears the deck.

Weak hands get flushed. Positions get reset. And once the smoke clears, the market finds its footing.

So while everyone else is panicking on a Friday close, I’m watching closely.

Because these shakeouts often set the stage for the next big leg higher.

Between the Fed doing their dance and the witch showing her face, I’m in no rush here.

Let’s let Monday and Tuesday shake out. Watch the flows. See who’s really in control.

Next week we will have some new options trades.

Then we’ll step in with fresh setups and clear recommendations.

I’m still leaning higher. The trend hasn’t broken. The leaders are still leading.

But what about you? Where do you think this thing is headed?

🏆 AAO Portfolio Highlights – June 2025

YTD Futures Portfolio Return: +33.5%

→ That’s over 30% ahead of the S&P 500.Top Performers: (3x the returns for futures accounting for leverage)

Lean Hogs (LH1): +38.0%

Gold Miners (GDXJ): +61.0%

Poland (EPOL): +43.1%

Copper (HG1): +21.8%

Silver (SI1): +26.8%

3-to-8x Call Option Winners in the precious metals trade this year — and we're still holding the best of them. Subscribe for less than a dollar a day to get access to all of our trades.

We’re not chasing narratives. We’re following the signals.

With rotation accelerating, international ETFs and commodities continue to dominate leadership — just as we outlined in the Reflation Playbook.

Let’s keep pressing.

Against All Odds Research

Stay Connected:

YouTube: Against All Odds Research Channel (@againstalloddsresearch)

Twitter: Jason P (@jasonp138)

Substack: AAO Research

Support the Bees: Help save the native bees! Learn more and get involved here.