What to Buy as the Dragon Bounces Back: System Addict

"The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

A surge in Chinese consumption and production impacts far more than just Asian economies—It reaches every corner of the globe. China’s relentless appetite for commodities has long shaped international markets, establishing it as the world’s largest consumer of key raw materials. From fueling its rapidly expanding cities to powering its massive industrial sector, China's demand stretches across a wide range of resources, leaving a profound imprint on global markets.

Its massive consumption of iron ore, coal, and crude oil drives its construction, energy, and manufacturing sectors, while its dominance in importing copper, aluminum, and nickel is pivotal for electronics, transportation, and the rise of electric vehicles. Agriculture isn't left behind either, with China leading in soybean consumption to support its booming livestock industry.

As China continues to modernize, its role in the commodities market becomes even more crucial. From the steel used to build its cities to the energy powering its factories, the country’s influence touches nearly every aspect of the global supply chain. This voracious demand not only affects prices but also sparks geopolitical shifts, as nations across the world scramble to supply China’s growing needs.

With favorable demographics and a population of 1.4 billion—we need to dig deeper in to China and the macro trades that are building within.

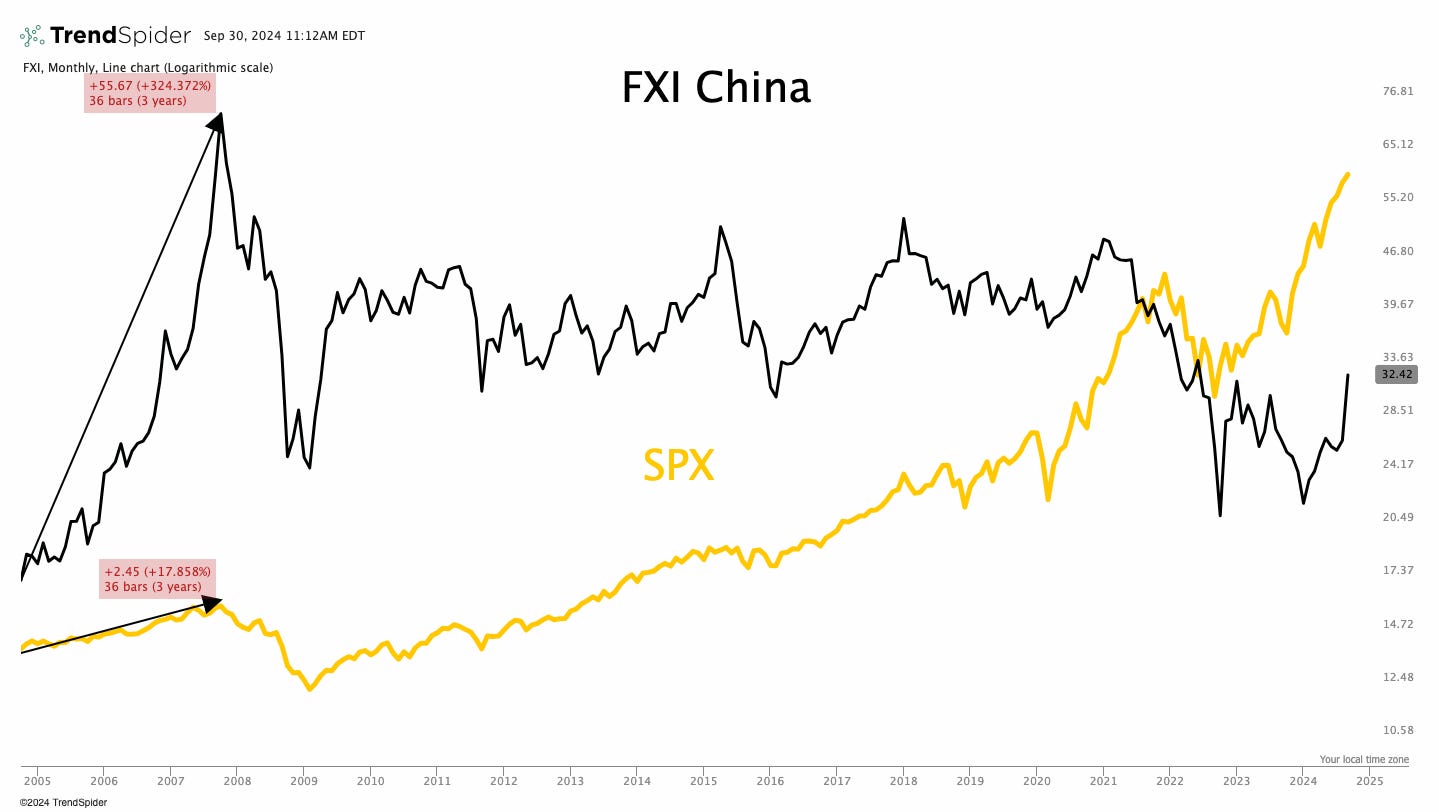

Investing in China isn’t always simple. (We recommended buying China on March 12th) We need multiple strong reasons to justify doing so. For me, price action is always at the top of the list. It signals what is to come and what the biggest investors are doing. Most importantly, what they are seeing.

During the 2000s, FXI, the China large-cap ETF, delivered outstanding performance.

Over 300% as we came out of the recession after the dot com crash. (The ETF starts in 2004.)

I also want to share insights on other areas I expect to see movement and give you a clearer picture of my current thinking. Overall, I believe agriculture, soft commodities, energy, and sectors that benefit from these trends could be preparing for an upward shift. (I have been writing about this a lot lately because the set up continues to go in the direction of reflation/inflation.)

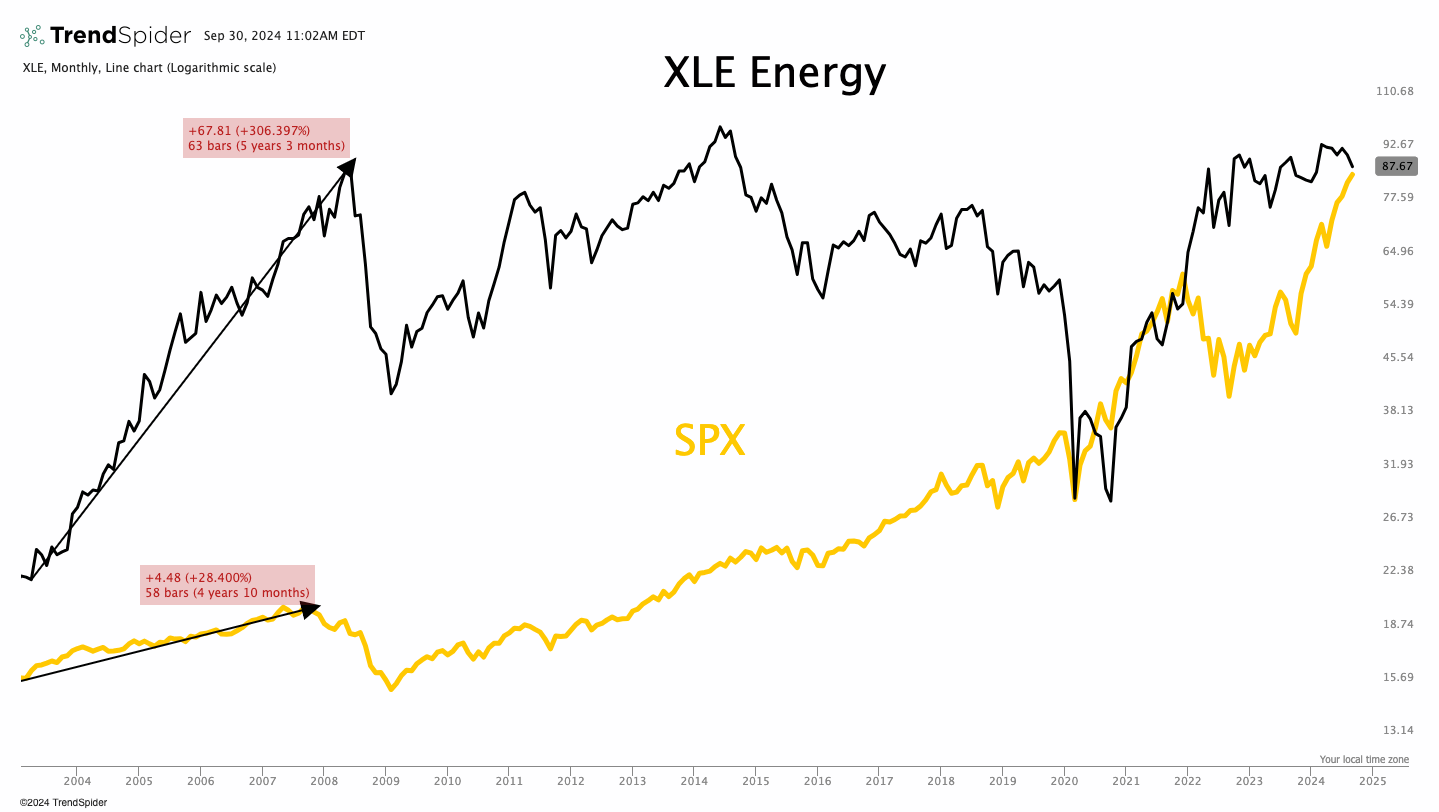

Energy also made a huge jump in the 2000s.

From the market bottom in 2003 to its peak in 2008, the energy sector experienced a remarkable 300% increase. This period saw a combination of factors driving the surge, including rising global demand, tightening supply, and geopolitical tensions that pushed oil and gas prices higher. The boom in energy wasn't limited to just one commodity but spanned across oil, natural gas, and other energy resources, contributing to substantial growth in the sector. This kind of movement underscores how pivotal energy can be as a driving force in broader market dynamics during times of global economic expansion.

And a boom in China=a boom globally.

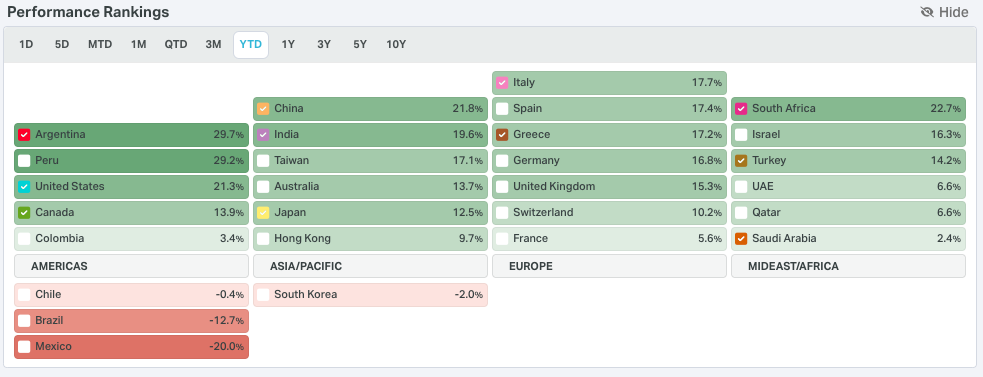

Globally we have a on of areas that have value. More than anything, I would like to talk about a theme that I am seeing.

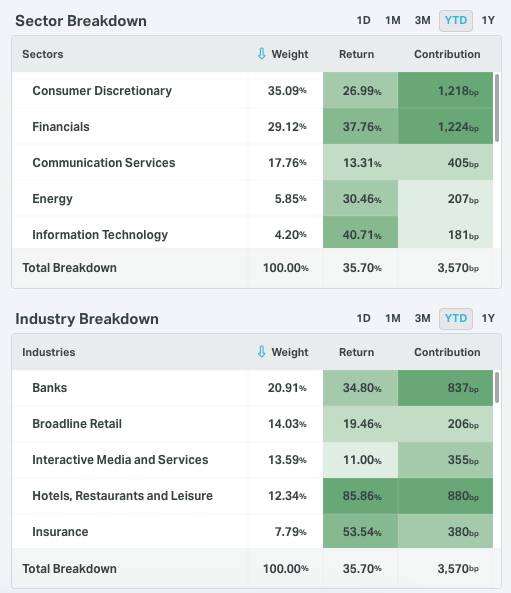

Money is flowing, and continues to flow, into sectors that are less reliant on technology. China does have some technology stocks but it is not the largest weighting.

Banks, financials, and services dominate much of the large-cap space in China. The conditions that favor banks also tend to benefit sectors like energy and industrial commodities, creating a supportive environment for growth across these industries.

This is also part of the gold story as you all have heard me say too many times… “Gold rings the dinner bell for the commodity cycle.” Within the next few months I believe most commodities will start to move higher and follow this move in gold. This environment starts the commodity cycle as we come out of a yield curve inversion.

The Chinese have a deep cultural and economic affinity for gold, valuing it both as a symbol of wealth and a stable investment. Gold is often seen as a store of value in times of uncertainty, making it a popular asset among Chinese investors seeking to safeguard their wealth. Additionally, gold plays a significant role in traditional celebrations, such as weddings and the Lunar New Year, where it is given as a cherished gift. China is also the world’s largest consumer of gold, with demand spanning from individual buyers to central bank reserves.

The game plan is to still own the areas that we are long and add things as we get signals.

Keep reading with a 7-day free trial

Subscribe to Against All Odds Research to keep reading this post and get 7 days of free access to the full post archives.